Investment Newsletter – November 2013

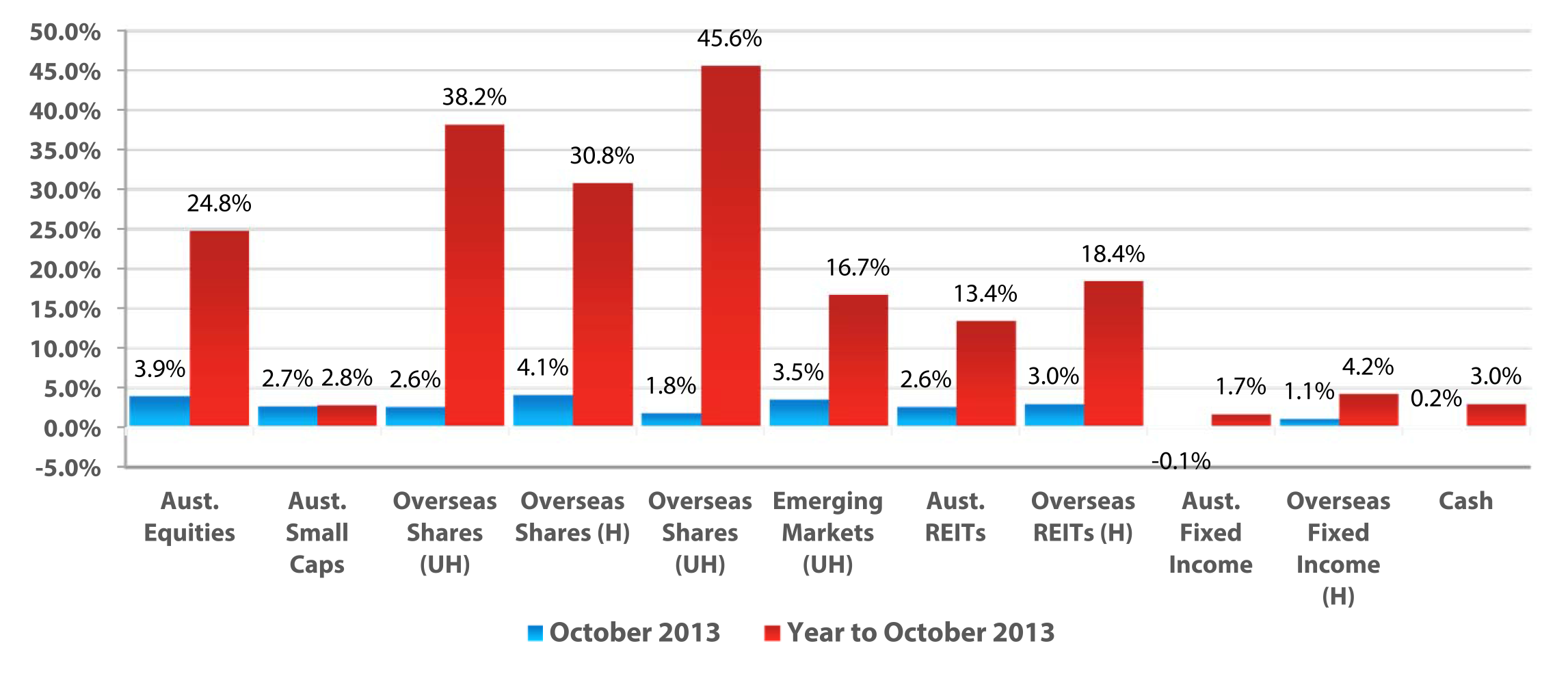

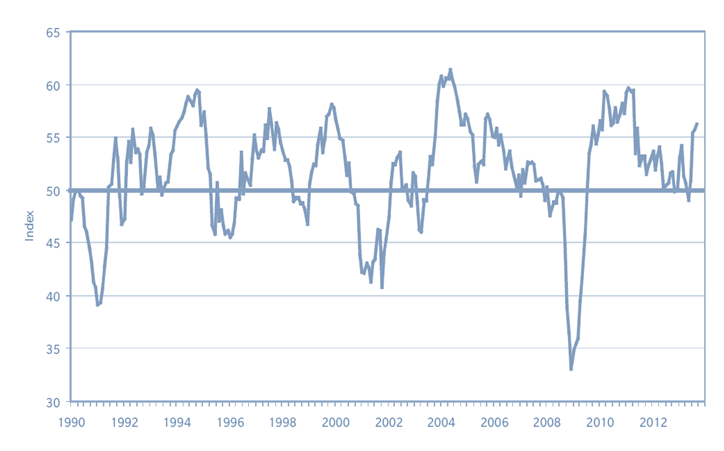

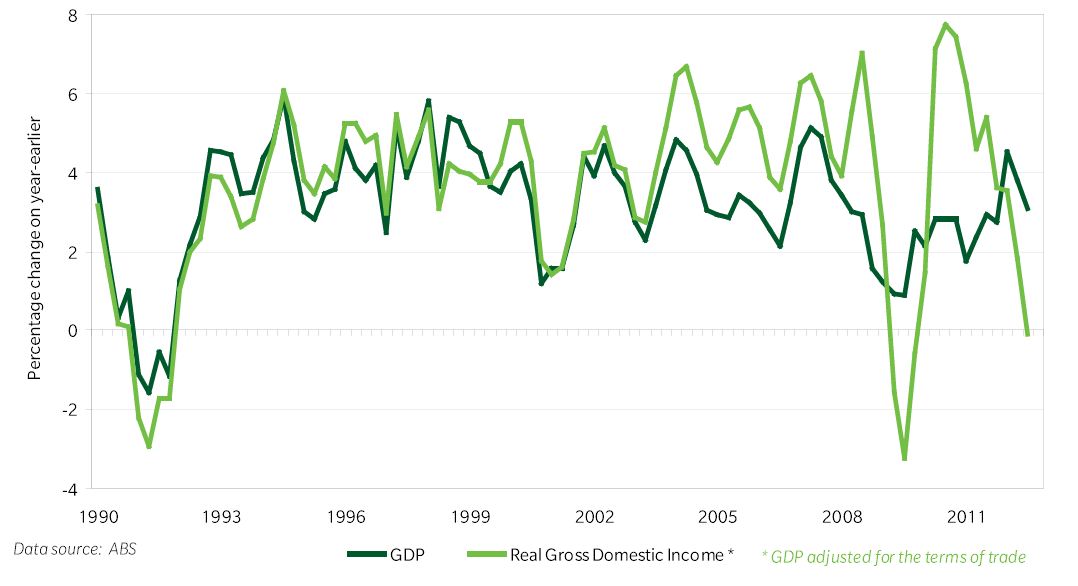

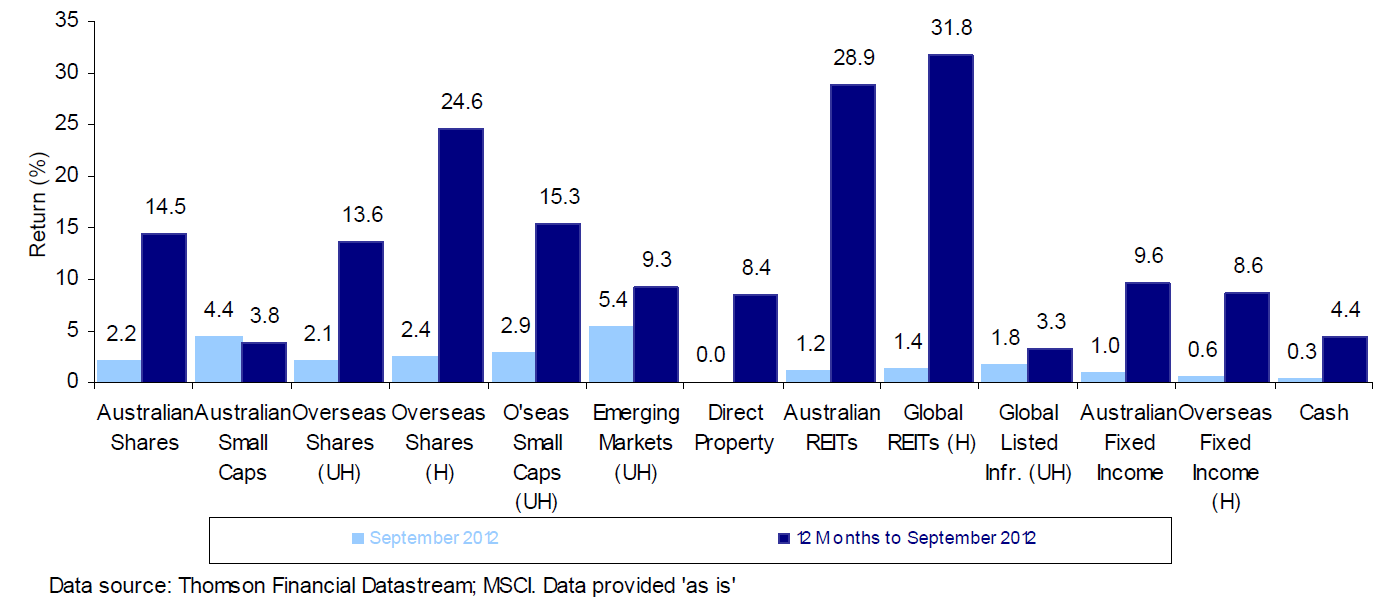

Director's Perspective By Inbam Devadason Global share markets have continued to trend upwards, with some stabilisation over the month of November 2013. Global economic growth has improved over the last 6 months and in particular, even Europe has returned to modest growth. In Australia, business and consumer confidence levels have improved over the last 3