Global equity markets have been mixed during the month of November. Some of the key themes affecting the market are as follows:

Australian Economy

Australian economic growth appears to be moderating with consensus growth for 2013 being 2.5% pa. Key drags on growth remain the high $A, some new mining projects being cancelled or postponed, slow credit growth and slowing global growth. The Reserve Bank of Australia (RBA) is expected to reduce the official cash rate in the next few months to assist in stimulating additional economic activity.

Global Manufacturing

Global manufacturing indices provide a useful insight into the current and expected future level of economic activity. A measure of 50 or more indicates growth in manufacturing activity. The chart below indicates that although the index has dropped since the beginning of 2011, it is currently stabilising and starting to edge up towards 50.

Global Manufacturing Conditions

Shares Remain Cheap

Shares remain cheap relative to bonds as indicated by roughly a 6% gap between equity yields and bond yields as indicated in the chart below. The chart shows the earnings yield on the Australian share market relative to 10 year Australian government bonds, and a similar measure for the US market.

Share v Bond Earning Yield Over 10 Years

US Fiscal Cliff & Economic Data

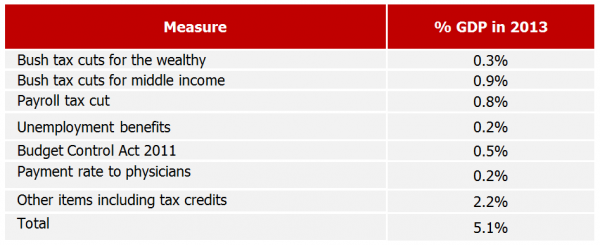

The current legislated 2013 US government tax increases and spending cuts would reduce US Gross Domestic Product (GDP) by 5.1% (see table below). However it is expected that President Obama will be able to adjust this position to have a much smaller impact on the US economy.

US Fiscal Cliff – 2013 Fiscal Drag Under Current Law

Greece Debt Rescue Package

The International Monetary Fund (IMF) and European Union (EU) have approved the release of additional funding of Euro$43.7 billion payable up to March 2013. This ensures that Greece will continue to meet its financial obligations. The Greek economy remains in recession with high unemployment.

Selected Market Indicators Commentary for the Month Ending 31 October 2012

By Asset Class

Australian Shares

The Australian market performed strongly in October with the ASX 300 finishing the month up +2.9%. The positive returns were largely driven by good performances by Telecommunications (+5.7%), Property Trusts (+5.3%) and Industrials (+3.2%).

Overseas Shares

Conversely, October was a weak month from global share markets as investors showed concern over the US fiscal cliff and disappointing economic data coming out of Europe. Global shares returned -0.8% in US dollar terms.

US stocks were the weakest performing, returning -1.8% over the month; reflecting concern over the results of the US election.

European markets were slightly more positive on the back of reduced trail risk after the European Central Bank’s bond purchasing program. The French CAC 40 performed best returning +2.2%, with the UK FTSE and German DAX returning +0.9% and +0.6% respectively.

Asian markets were the strongest performing in October with Hong Kong’s Hang Seng (+4.0%) and Japan’s TOPIX (+0.7%) making positive returns.

Property

Real Estate Investment Trusts (REITs) performed strongly over the month of October as investors continued to seek higher yields. Domestic REITs gained +5.3%, while global REITs were also up +1.4%.

Fixed Interest

Sovereign bond yields were mainly up over the month in major economies. In Australia, bond yields rose despite a cut in the cash rate and growing concern over how long the mining boom might last. Ten year bonds rose +0.15% to finish the month at +3.06%. Ten year bond yields were also up in the UK (+0.31%), the US (+0.05%), Germany (+0.02%) and Japan (+0.02%)

Australian Dollar

The Australian dollar performed weakly in October, falling against all major currencies with the exception of the Japanese Yen. It performed weakest against the Euro, falling by -1.0%, while making smaller losses against the US Dollar (-0.3%) and the UK Pound Sterling (-0.1%).

Leave A Comment

You must be logged in to post a comment.