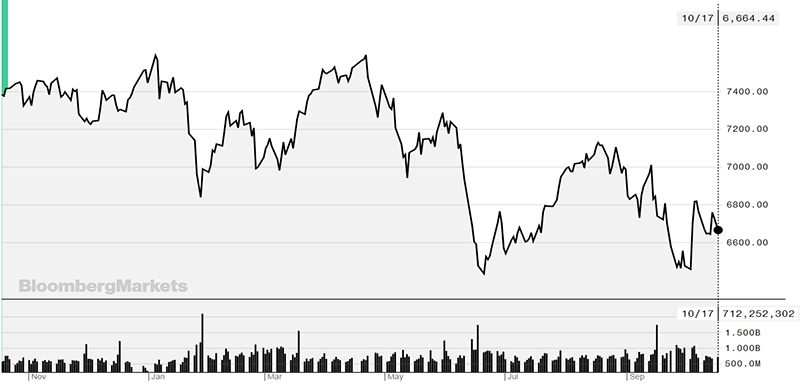

Difficult (ie negative) market conditions continue to persist. At the time of writing, the ASX 200 is down 10.95% for the year. Before you get overly concerned, this particular index doesn’t include dividends, which always generate a positive return of approximately 4.5% (excluding franking credits).

S&P/ASX 200 Index – 1 yr movement to 18 October 2022

Source: Bloomberg Markets

It’s also helpful (and reassuring) to have some context for the above result. If we look at the same index over the past five years we can start to see why we emphasise the importance of having a long term investment horizon.

S&P/ASX 200 Index – 5 yr movement to 18 October 2022

Source: Bloomberg Markets

Over the past 5 years, it has returned 14.4% even after allowing for the current fall and the falls in March 2020 and at the end of 2018.

What is compounding the current volatility (the main driver of which is high inflation and the consequent necessity for central banks to raise interest rates) is the recent turmoil in markets caused by the new British Governments announcement and subsequent backflip regarding debt funded tax cuts.

So, the initial flapping of the butterfly’s wings was back on September 24th when Liz Truss announced that the 45% tax rate, for those earning over GBP150,000pa, would be scrapped, and thereby reducing government revenue by GBP45,000,000! This loss of revenue was to be funded by the issuing of more government debt. This was both questionable policy and extremely poor economics. The outcome of which was an entirely predictable plunge in the value of British Government bonds (known as gilts).

Back in December 2021, the 30-year British government bond was paying an interest rate of just 0.8 per cent. In price terms, the 30-year gilt was trading at GBP111. Fast-forward nine months and the interest rates on 30-year gilts hit about 5 per cent at one point in September, up almost 200 basis points from 3.2 per cent 27 days prior (or up 420 basis points from December)! And, of course there was a consequent fall in the price of the gilt from GBP111 to GBP43. A fall of 61%!

So why the reference to the “Butterfly Effect”? The huge increase in gilt yields and even more dramatic fall in gilt prices inflicted massive losses on UK investors including UK pension funds. This in turn forced them sell off their investments around the world to meet margin calls on their derivative exposures thus creating a chain reaction across all markets globally.

To restore some sanity, the Bank of England was forced to intervene by buying back gilts to try and stabilise the price and the yield. It indicated that it would keep doing so until order and market liquidity were achieved. The yield (effective interest rate) on Gilts is the basis for the risk-free rate that underpins bank lending rates. Thus, the huge swings in gilt yields were making it near impossible for UK banks to price mortgages and corporate loans, with the consequent risk of potentially limiting the amount of credit available. If corporates can’t borrow, economies grind to a halt pretty quickly. So it was critically important for the BoE to act as it did.

Thankfully the decision to reduce taxes has now been reversed but not before significant collateral damage was caused.

The correction in Australian house prices is also persisting. National capital city prices have fallen another 1.3% in September, bringing the peak-to-trough drawdown to 5.7%. Based on the last quarter of data from CoreLogic, national metropolitan prices are falling at more than 16 per cent a year on an annualised basis.

In Sydney, home values are on track for a third month of circa 2% losses and have plunged by more than 9% from their recent peak. They are correcting at 22% a year annualised. After delaying the inevitable for a few months, Brisbane prices are now falling as well, dropping 1.7% in the first 29 days of September after falling by a record 1.9% in the month prior.

It is a more subdued story in Melbourne where dwelling values have “only” dropped by another one per cent so far in September, bringing the peak-to-trough loss to more than 5.6 per cent. Melbourne prices are falling at 14% a year.