Late last year, when Harvest was thinking about factors that would drive the investment landscape in 2022, four key themes emerged. Just quickly they were:

- Monetary & Fiscal Policy (reduced Quantitative Easing and increased Government spending)

- Inflation (inflation now looking to be more systemic than transitory)

- Interest rates (now clear the US Federal Reserve will increase US cash rates this year)

- Increasing tension between China and the West.

To that list we now need to add war between Russia and Ukraine. Does this change our thinking on how we should approach investing? In short, the answer is no. Whilst no-one wants war, one of the perverse outcomes of war is that they’re expansionary. That is, governments must increase spending in order to support the war effort. However, they also increase market nervousness, which leads to increased short term market volatility.

So, we now have two drivers of short-term market volatility: the Ukraine situation and the timing of future Interest rate rise announcements. With the above themes in mind, here is our broad outlook for the main asset classes.

Equities

We’re still very confident in the outlook for equities. Earnings growth, as companies rebound from the pandemic, is looking very strong. Next year, company earnings growth in Australia is forecast to be in the 8-10% range and even higher in the US. We do not expect this to be impacted by the war in Ukraine.

The only negative for equities is the potential for increases in interest rates. If and when those rate rises are announced, there will be increased volatility in markets and companies that don’t have strong balance sheets will be hardest hit.

The active fund managers that Harvest recommends in your super and investment accounts, are fully aware of this potential and are already positioning their portfolios to weather this volatility. As always, our message is don’t panic, stay invested!

This message is particularly important for our retired clients as equities are currently the best source of the income return that you need to fund your pension payments.

Fixed Interest

The potential for interest rate hikes makes government bonds less attractive for the next year or so. But the trajectory of the world economy is up, and this growth will be partly fuelled by new corporate bond issuance, including “green bonds”. We’re therefore cautiously optimistic about the performance of this sub-sector. Also, inflation linked bonds will come to the fore.

Again, the actively managed, diversified bond fund managers that Harvest utilise, are aware of these factors and will reposition their portfolios accordingly.

Property

Whenever there is talk of inflation, you will usually find chatter about investing in Gold as an inflation hedge. The reality is that Property is an even better inflation hedge, and it also has the added benefit of providing an income return. We expect property to perform well this year.

Infrastructure

As the push towards Net Zero gains momentum, there will be increasing momentum in investment in infrastructure to de-carbonise the world economy. We anticipate steady (rather than spectacular) long term growth in this sector. Infrastructure is also a terrific inflation hedge as many infrastructure contracts have CPI increases built into their revenue agreements (eg the annual increases in tolls for Toll Roads are usually tied to a CPI measure).

Additional Note post Russia’s invasion of Ukraine

A new dimension of risk has entered the financial markets now that Russia has invaded Ukraine. It’s not something the markets needed when they were already dealing with brisk inflation and preparing for an expected cycle of interest rate hikes from most of the world’s central banks.

However, what history tells us about markets during times of geopolitical risk is that they’re very resilient. Whilst we expect some increased volatility in the short term, we do expect markets to recover fairly quickly.

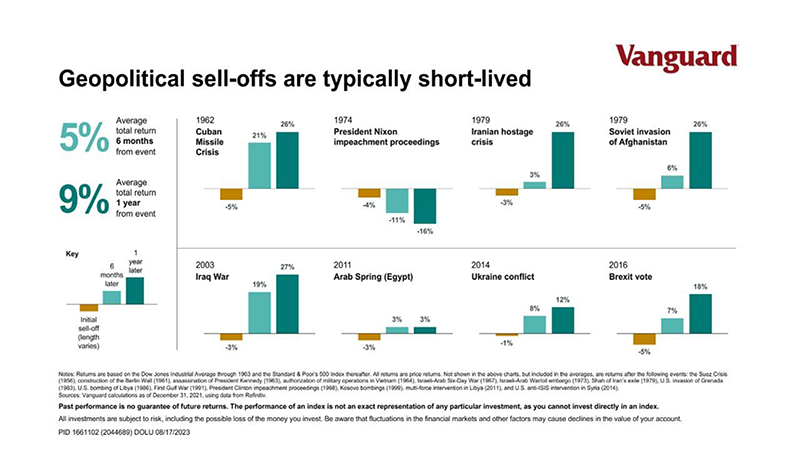

To support this claim, the chart below, courtesy of Vanguard, shows the response of markets to some previous crises.

As can be seen, whilst there is an initial market downturn, markets move back rapidly to positive territory within a year and often within 6 months.

So our message is as always: stay invested!