In the process of writing our February newsletter, Russian President Vladimir Putin invaded Ukraine and, as a postscript to that newsletter, we provided evidence that staying invested (ie not panicking) was the best course of action.

In the three and a bit, weeks since that newsletter came out, we’ve seen the horrific consequences of the invasion on the valiant Ukrainian people and their country. And we’re continuing to field calls from clients who are understandably nervous about the impact of the war on their savings.

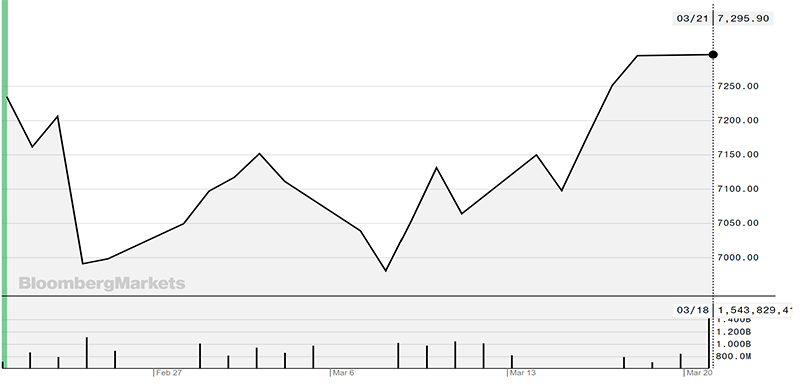

So, without in any way wishing to downplay the horrors of war it is important that we again reinforce our message of sticking to your investment strategy. Here’s why. As can be seen in the chart below, which shows the ASX200 over the past four weeks, the market is now actually higher than it was immediately prior to the invasion. Good news, but that’s not the key message. The key takeout is that from day to day, the market has had significant falls followed by equally large rises. This is known as a “Random Walk” and emphasises how difficult it is to predict what’s going to happen to markets in the short term. The only thing we can confidently predict is the long-term underlying trend (which for the Australian share market is an 8-9% annual return if you stay invested for a 10-year period).

S&P/ASX 200 Index – 1 month movement to 20 March 2022

Source: Bloomberg Markets

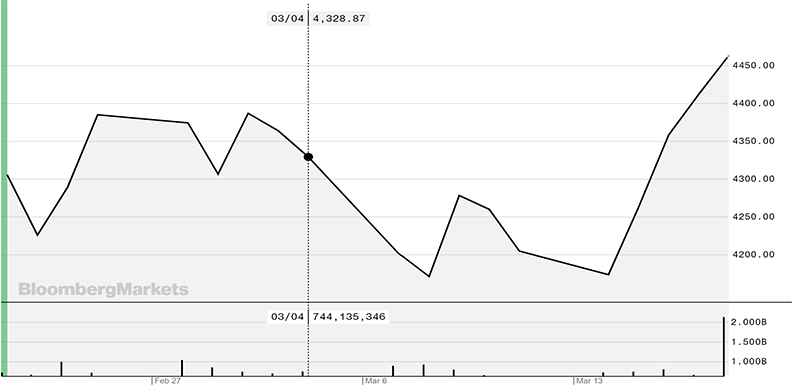

In what should have been major news but was relegated to the finance pages due to Putin’s war, the US Federal Reserve (The US equivalent of our Reserve Bank) increased interest rates by 0.25%. This rise was very well flagged and US markets (as measured by the S&P500) actually rose, even though theory suggests they should have fallen.

US S&P 500 Index – 1 month movement to 20 March 2022

Source: Bloomberg Markets

Also clearly flagged are further interest rate rises this year as the US grapples with inflation which is currently running at 7.5%. We’re anticipating further market volatility as a result but US economic growth is strong so there are no real causes for concern.

The US rate rises have naturally focussed attention on whether the RBA will follow likewise. For the past few years, the Governor of the RBA, Philip Lowe, has been quite clearly indicating that Australian interest rates would not rise until 2024 at the earliest. That rhetoric ceased a few months ago now and it’s clear that the RBA is leaving open the possibility of raising interest rates early than that. The market consensus is that we’ll see an increase of 0.1% in August or September. Australia’s inflation rate is currently running at 3.5% which is just above the RBA’s target range of 2-3%. In spite of the pain we’re all feeling at the petrol bowser, the RBA may not feel that there’s too much cause for concern as there are no significant signs of wage inflation. But just to be on the safe side those of you with mortgages should budget now for an increase in your variable home loan rate.

The possibility of interest rate rise has certainly had an impact on house price increase, which after, the extraordinary rises of 2020-21 are now showing signs of tapering off as hinted at in the chart below. Auction clearance rates are also falling, dropping from 88% this time last year to 65%, which is further evidence that the market is cooling off.