Investment Market Commentary

Global equity markets have performed strongly during the months of December 2012 and January 2013. Some key themes affecting the market are as follows:

Australia

- Australian business confidence increased significantly to +3 (up from -9) in December 2012. The increase is due to the Australian RBA rate cut in December 2012 and improving global economic condition.

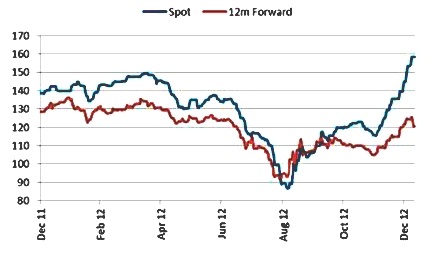

- Commodity prices have been increasing in recent months – in particular the spot price of iron ore is up to around $150/MT (from a low of $90/MT in August 2012) which will improve resource sector profits for financial year 2013. See chart below.

Iron Ore Spot and Forwards Prices

- Equity markets have rallied strongly for the period July 2012 to January 2013.

US

- US Federal Reserve announced an extension of quantitative easing (i.e. buying US government bonds to keep interest rates low) from January 2013.

- US Congress have passed a deal that averted the uncertainty around the fiscal cliff providing confidence that the US economy will continue to grow.

- US economic growth for the quarter ending 30 September 2012 was revised upwards to 3.1%. This result was largely due to an increase in exports and government spending.

- The US housing market continued to improve reflected by a 0.5% price increase and 5.9% increase is existing home sales in December 2012

Europe

- Eurozone Finance ministers formally approved a further 49.1 billion euro financial assistance package to be implemented by the end of March 2013. Standard & Poor’s have raised Greece’s credit rating 6 notches from selective default to B- as the international bailout reduced the imminent threat of Greek bankruptcy.

- European Union (EU) policy makers still face an ailing economy. The Eurozone unemployment rate hit a record 11.8% in November 2012. The manufacturing sector had its seventh consecutive month of contraction with the Eurozone PMI falling to 46.1 in December 2012 (a figure less than 50 signals contraction).

China

- China’s manufacturing sector expanded in December 2012. The HSBC PMI (Purchasing Managers Index) was up to 51.5 in December 2012 (more than 50 signals expansion).

Key Global Economic Themes

- Risk on – Equity and other risk assets enjoyed further recovery in December 2012 on the back of positive economic data from the US and China.

- The search for yield continues to drive investor behaviours – Sovereign bond yields rose as investors sought higher-yielding opportunities elsewhere (including equities).

- China’s cyclical downturn may have reached bottom – Strengthening industrial production indicators and improvements in demand indicate China’s economy may have bottomed in the third Quarter of 2012.

- Positive sentiment in Europe as Greece out of immediate danger – Greece’s credit rating was raised from “selective-default” to B- as Greece’s bond buyback and the international bailout programme removed the immediate threat of bankruptcy and exit from the Eurozone.

Investment Market Performance

Selected Market Indicators Commentary for the Month ending 31 December 2012

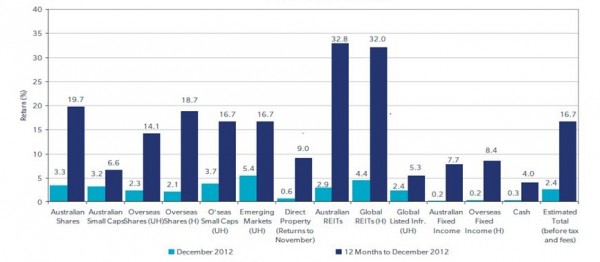

Asset Class Returns

Australian Shares

Australian shares finished the 2012 calendar year up on the back of positive economic news from China. The S&P ASX 300 finished the month of December up +3.3% driven by strong performances from the Industrials Sector (+5.8%), the Materials Sector (+4.8%) and the Utilities Sector (+4.1%).

Overseas Shares

Overall, overseas share market returns were positive for the month of December 2012. Emerging markets performed strongly with China and Brazil being the best in those markets.

US Stocks also posted positive returns however were lower than most other regions with the S&P 500 Composite Index returning +0.9% for the month.

European markets were also positive reflecting cautious investor approval of European policy makers strategies to continue to help the Eurozone back to economic health. The German DAX (+2.8%), the French CAC 40 (+2.6% and the UK FTSE 100 (+0.6%) were the strongest performing European markets.

Asian markets were the strongest performing markets for the month with particularly strong performances from China’s Shanghai Composite Index (+14.6%) and Japan’s TOPIX (+10.1%)

Property

Real Estate Investment Trusts (REITs) performed strongly with Domestic REITs up +2.9% and Global REITs up +4.4%.

Fixed Interest

Sovereign bond yields were mainly up over the month in major economies. In Australia, 10 year bond yields rose to 3.27%. 10 Year bond yields also rose in the US (to 1.75%), the UK (to 1.82%) and in Japan (to 0.79%). German 10 year bonds were the weakest performing for the month falling to 1.18% from 1.25% the month before.

Australian Dollar

The Australian dollar generally fell in December against all major currencies with the exception of the Japanese Yen. The Australian dollar fell -0.5% against the US$, -1.9% against the Pound Sterling and -1.8% against the Euro. However, the $A performed strongly against the Japanese Yen, appreciating +4.3% for the month.

Leave A Comment

You must be logged in to post a comment.