Investment Market Update

Global equity markets have performed strongly in 2013 year to date. Since the US debt ceiling was raised this month equity markets have continued to rise strongly.

The equity market performances reflect increased confidence that the global economy is recovering. The delay in the US Federal Reserve reducing its bond buying from the current US$85 billion per month, has kept a lid on US government bond rates. This is supportive for US economic growth. Some key themes affecting the market are as follows:

Australia

- The RBA (Reserve Bank of Australia) kept the official cash rate at 2.5% in October as global economic conditions show signs of improvement.

- Australian GDP growth for the quarter ended 30 June 2013 was +0.6%, resulting in annual growth of +2.6% which is slightly below recent growth levels.

- Australian unemployment reduced to 5.6% in September 2013 (down from 5.7% in June 2013). However, this rate is expected to increase somewhat over 2013/14.

- Australian business confidence rose significantly during the quarter ended 30 September 2013. The NAB Business Confidence Index rose 8 points to 12.

Europe

- The Eurozone has emerged from an 18 month long recession to grow by 0.3% in the quarter ending 30 June 2013. Key growth countries were Germany (+0.7%) and France (+0.5%).

- Eurozone manufacturing accelerated over the September 2013 quarter. The Manufacturing PMI index was 51.1 in September 2013.

- Euro area unemployment dropped slightly to 12.0% in August 2013. However there are still over 19 million people unemployed in the region.

United States

- US economic growth for the quarter ended 30 June 2013 was 2.5% driven by stronger exports and lower imports.

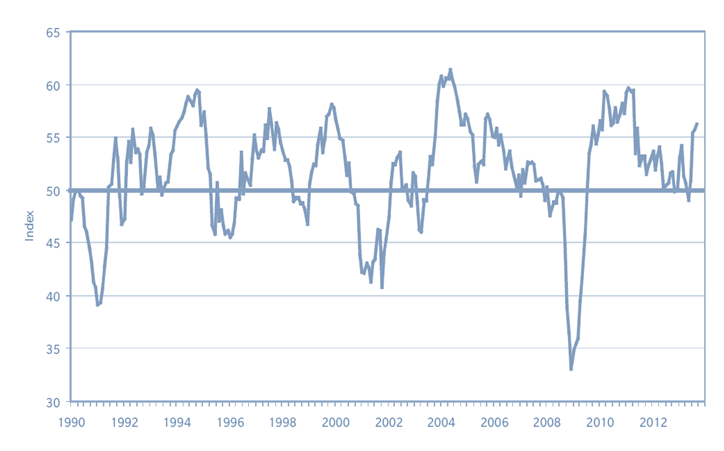

- The Manufacturing PMI index rose to 56.2 in September 2013 (up from 50.9 in June). See graph below showing movement in the Index over the last 13 years.

US ISM Manufacturing Index

- The US economy added 169,000 new jobs in August 2013 and has averaged 184,000 new jobs per month over the last year.

- The US housing market, as measured by S&P/Case Shiller House Price Index rose at an annualised rate of 12.4% in the year to July 2013.

China/Japan

- China’s annual GPD growth increased to 7.8% pa in the quarter ending 30 September 2013. This was the fastest quarterly growth for the last 12 months.

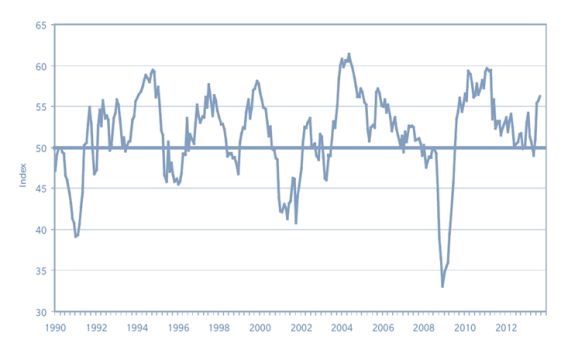

- Chinese manufacturing returned to growth in August with the HSBC China Manufacturing PMI rising to 50.2 in September (up from 50.1 in August).

- The Japanese economy grew at an annualised rate of 3.8% in the June 2013 Quarter. The Japanese policy stimulus is showing signs of generating momentum.

Commodity Prices

- Significant commodity price movements for the September 2013 quarter include Iron Ore up 12.6% to US$134/MT, oil up 5.3% to $108 and gold up 9.5% to US$1,331.

Investment Market Performance

Selected Market Indicators Commentary for the Month ending 30 September 2013

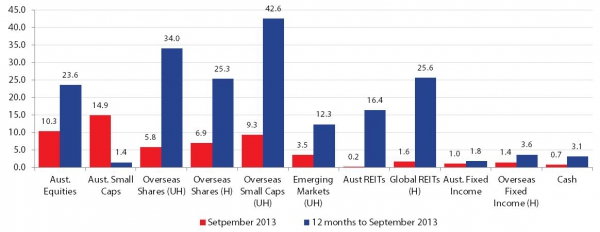

Asset Class Returns

Source: Thomson Financial Datastream; MSCI data provided ‘as is’. Prepared by Harvest Financial Group.

Australian Shares

Australian equities returned +2.2% for the month of September. Investor confidence was boosted by the continuation of the U.S. Federal Reserve’s Quantitative Easing programme. The best performing sectors for the month were Industrials (+5.6%), Information Technology (+3.6%) and Consumer Discretionary (+3.0%). Healthcare (-1.8%) was the weakest sector in September.

Overseas Shares

Global equity markets were also generally up over the month of September with the MSCI World ex. Australia Index returning +3.9% for the month in hedged terms. The strongest performing global sectors were Industrials (+2.2%) and Consumer Discretionary (+1.8%) while Energy (-2.2%) and Consumer Staples (-1.7%) were the weakest performing global sectors for the month.

Markets in the U.S. performed strongly in September with investor confidence buoyed by the surprise decision by the Federal Reserve to delay the tapering of its monthly asset purchases. Both the NSADAQ (+5.1%) and the U.S. S&P 500 Composite Index (+3.1%) were up in September.

European markets were also up in September with the German DAX 30 being the strongest performer up +6.1% on the back of the re-election of Angela Merkel for her third term. Other European markets including the French CAC 40 (+5.5%) and the UK FTSE 100 (+0.9%) were also up for the month.

Asian markets also performed strongly with the Japanese TOPIX (+8.7%) and the Indian BSE500 (+5.2%) among the strongest performing markets.

Property

Real Estate Investment Trusts (REITs) performed well in September with domestic REITs returning +0.9% for the month, while global REIT’s gained +4.7% on a fully hedged basis.

Fixed Interest (Bonds)

Global sovereign bond yields were generally down across the board in September with 10 year bond yields down in the US (-13 bps to 2.62%), the UK (-6 bps to 2.54%) and Germany

(-13 bps to 1.73%) experiencing the largest losses.

Australian bond yields were also down over the month with 10 year bond yields falling -9bps to 3.81% and 2 year bond yields down -3 bps to 3.17%.

Australian Dollar

The Australian dollar appreciated against all major currencies in September. The A$ rose +5.0% against the US$, finishing August at US$0.935. The A$ also appreciated against the Euro (+2.3%), and the Pound Sterling (+0.3%).

Leave A Comment

You must be logged in to post a comment.