Investment Market Update

Global equity markets have performed strongly during the months of January and February 2013. We have seen some short term pullback in the last week, mainly over an uncertain election result in Italy. Some key themes affecting the market are as follows:

Australia

- The RBA (Reserve Bank of Australia) kept the official cash rate at 3% as Global economic conditions are showing signs of improving.

- Australian inflation rose 0.2% for quarter to 31 December 2013 and 2.2% for the year ending 31 December 2012. This is at the low end of the RBA target range of 2-3% pa.

- Australian unemployment remained at 5.4% mainly due to a reduction in the participation rate. This rate is expected to increase slightly over 2013.

- Australian company half year profit reporting season has been better than expected with some companies reporting some positive earnings surprises.

- Most commodity prices rose over January 2013. The iron ore price was up 8.5% to $US153/MT. The oil price rose 6.3% to US$97.7/bbl.

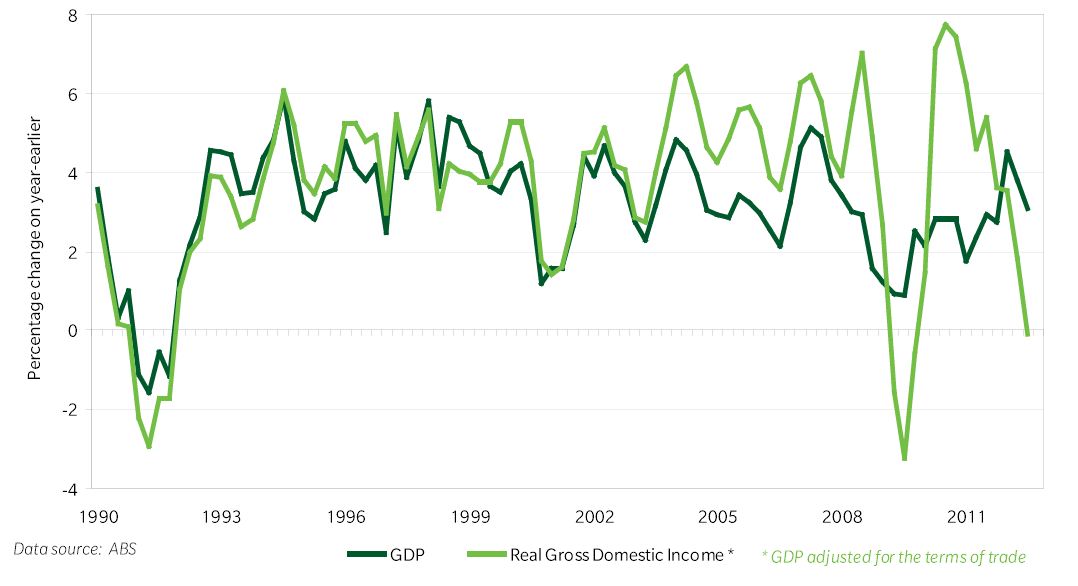

- Australian economic growth forecast for 2013 are 2.6%. As the mining boom is expected to have peaked, some risk remains on the downside. See chart below for recent growth results.

Australia – Real Domestic Production and Income

United States

- US economic growth initial estimates for the quarter ending 31 December 2012 disappointed markets, declining by -0.1% pa. This result was largely due to a reduction in defence spending, slow growth in company inventories and large disruptions from Hurricane Sandy.

- The US jobless rate edged up to 7.9% in January.

- US house prices continued their recent rise being up 0.6% in November 2012.

- The US senate approved suspending the federal borrowing limit until May 2013. However at this stage some automatic spending cuts are due to take effect from March 2013. This is causing some uncertainty in markets.

Europe

- The Italian election this week has failed to provide a result. The market response was a panic with Italian and Spanish bond yields up sharply and European equity markets down sharply.

- The Eurozone unemployment rate remained high at 11.7% in December 2012. The manufacturing sector improved to an 11 month high with Eurozone PMI rising 1.7 points to 47.9 in December 2012 (a figure less than 50 still signals contraction).

China/Japan

- China’s manufacturing sector expanded in January 2013. The HSBC PMI (Purchasing Managers Index) was up to 51.9 in January 2013 (more than 50 signals expansion).

- The Chinese inflation rate hit a seven month high of 2.5% in the quarter ending 31 December 2012, bringing the annual rate to 7.9%.

- The Bank of Japan (BOJ) confirmed an inflation target of 2% pa. The Japanese are using a combination of quantitative easing (i.e. buying Government Bonds) and additional government spending to reinflate the economy. The Japanese share market has responded strongly to these initiatives.

Investment Market Performance

Selected Market Indicators Commentary for the Month ending 31 December 2012

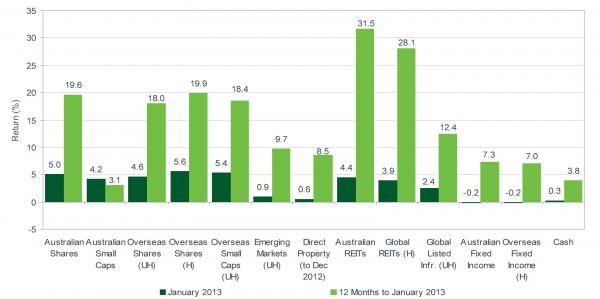

Asset Class Returns

Australian Shares

The S&P ASX 300 Accumulation Index finished the month of January up +5.0% reflecting a positive month for Australian Shares. All market sectors finished higher with IT (+14.7%), Consumer Discretionary (+8.5) and Energy (+6.0%) among the strongest performing.

Overseas Shares

International shares also had a strong month with the MSCI World ex Australia Index rising +4.6% in January. Positive global economic news is continuing to drive an increase in overall investor optimism which saw positive gains evenly spread among all global sectors (Healthcare +6.7%, Financials +5.8%, Energy +5.7% and Consumer Discretionary +5.2% to name a few).

Major Global Markets were also up in January. The US S&P500 posted its strongest monthly gain since October 2011 at +5.2% on the back of positive corporate earnings figures.

European Markets were also generally up with the UK FTSE 100 (+6.5%), the French CAC 40 (+2.5%) and the German Dax 30 (+2.1%) being the strongest performing markets.

Chinese recovery and central bank action in Japan saw strong gains from China’s Shanghai Composite Index (+5.1%) and Japan’s TOPIX (+9.4%) in January. Most other Asian markets including the Indian BSE 500 (+2.9%) and the Hong Kong Hang Seng Index (+1.5%) also made positive gains for the month.

Property

Real Estate Investment Trusts (REITs) performed strongly with Domestic REITs up +4.4% and Global REITs up +3.9%.

Fixed Interest

Bond prices fell over the month due to increased bond yields. 10 year bond yields rose across the globe with US (+24 bps to 1.99%), German (+44 bps to 1.62%) and Australian (+18 bps to 3.45%) 10 year bonds having the strongest yield increases.

Australian Sovereign bond prices fell over the month with further monetary easing measures expected from the RBA

Australian Dollar

The Australian dollar rose against all major currencies except the Euro (losing -2.4%) in January. The $A recovered its loss against the US$ in January finishing the month up +0.5% translating to a value of US$1.04. The $A performed particularly strongly, appreciating +6.0% against the Japanese Yen and +3.0% against the Pound Sterling (+3.0%).

Leave A Comment

You must be logged in to post a comment.