Investment Market Update

Global equity markets have performed well in 2013 year to date. August was a strong month for the Australian market but a weak month for most Global equity markets.

Tension with respect to potential military action against Syria caused some weakness in markets in August 2013. Other factors affecting markets in recent months have included signs that Europe is headed for modest growth in 2014, China’s economic growth rate is stabilising at a strong rate of 7% pa and the US and Japanese economic recoveries are gaining momentum.

Key risks remain US Federal Reserve tapering of bond buying by the end of 2013 and that European sovereign debt and unemployment issues. Some key themes affecting the market are as follows:

Australia

- The RBA (Reserve Bank of Australia) kept the official cash rate at 2.5% in September as Global economic conditions show signs of improvement and commodity prices have been moving up in the last 2 months.

- Australian unemployment increased to 5.8% (up from 5.7% in June 2013). This rate is expected to continue to increase slightly over 2013.

- The Australian Federal election result has been received well by markets. Prime Minister Tony Abbot has declared Australia “open for business” and committed to provide greater policy stability to assist business confidence and business planning. Historically, once an election is completed, share markets tend to perform well in the following 3 to 6 months due to knowing who will be in power. Key policy changes will be climate change, tax changes, less regulation, and targeting a faster return to surplus.

Europe

- The Euro area grew by 0.3% in Quarter 2, 2013. Germany and France grew by 0.7% and 0.5% during the quarter, while Spain and Italy had slightly negative growth of -0.1% and -0.2% for the quarter.

- Eurozone manufacturing accelerated over August as the Manufacturing PMI index hit a 26 month high of 51.4 (up from 50.3 in July). Euro area unemployment remained steady at 12.1% pa.

- Angela Merkel’s third victory in the German Election on the weekend has been received well as a stabilising influence for Europe.

United States

- US economic growth for the quarter ending 30 June 2013 was 2.5% driven by stronger exports, lower imports and higher manufacturing PMI, now at 55.7 in August (up from 55.4 in July).

- The US jobless rate fell to 7.3% in August 2013 (down 0.3% over the last 4 months) and at the lowest level since December 2008.

- The US housing market, as measured by S&P/Case Shiller House Price Index rose at an annualised rate of 12.1% in the year to June 2013.

China/Japan

- Chinese trade data in August showed export growth of 7.2% from a year earlier, up from 5.1% in July.

- Chinese manufacturing returned to growth in August with the HSBC China Manufacturing PMI rising to 50.1 in August (up from 47.7 in July).

- The Japanese economy grew at an annualised rate of 3.8% in quarter 2, 2013. The policy stimulus is showing signs of gaining momentum.

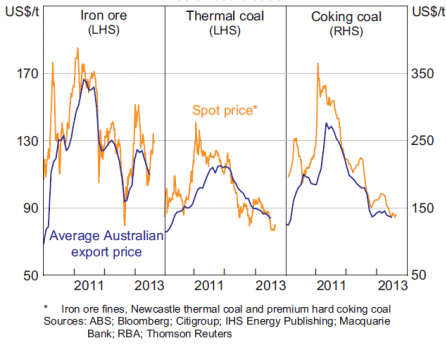

Commodity Prices

- Significant commodity price movements for the month of August include Iron Ore up 6.1% to US$140/MT, oil price up 7.2% to $115.63 and gold price up 6.7% to US$1397.63.

Bulk Commodity Prices

Investment Market Performance

Selected Market Indicators Commentary for the Month ending 31 August 2013

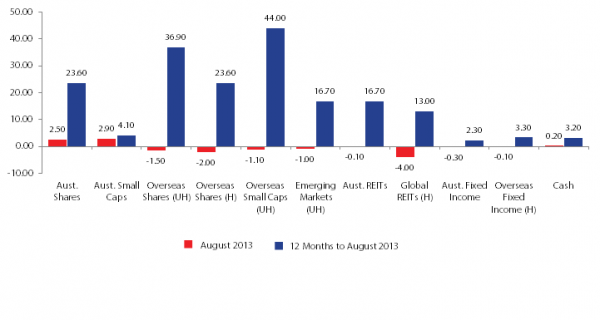

Asset Class Returns

Source: Thomson Financial Datastream; MSCI data provided ‘as is’. Prepared by Harvest Financial Group.

Australian Shares

Despite a global trend towards selling shares in August, the Australian share market managed to post a positive return of +2.5% for the month. The strongest performing sectors in August were the Energy sector (+5.2%), the Consumer Discretionary sector (+5.1%) and the Industrials sector (+4.7%).

Overseas Shares

Global share markets were generally down in August as a result of investor concern primarily over the possibility of US military action in Syria after it allegedly deployed chemical weapons on civilians. Overall, the MSCI World ex. Australia Index fell -2.0% in fully hedged in August. The strongest performing global sectors were the Materials sector (+2.0%) and the Information Technology sector (+0.3%), while the weakest performing sectors included the Utilities sector (-3.6%) and the Consumer Staples sector (-2.8%).

The US S&P 500 Composite Index underperformed most other global markets in August, returning -2.9% for the month. This underperformance was most likely driven by investor concern over the U.S. potential military action in Syria, coupled with news from the latest meeting of the U.S. Federal Reserve which indicated that the Fed may begin to taper off its Quantitative Easing measures as early as September.

European and Asian markets were also down in August with the French CAC40 (-1.5%), the German DAX40 (-2.1%), the UK’s FTSE 100 (-2.4%), the Japanese TOPIX (-2.2%) and the Indian BSE500 (-4.5%) being the weakest performing markets. The Chinese Shanghai Composite index was the notable exception returning +5.2% for the month of August.

Property

Real Estate Investment Trusts (REITs) performed weakly in August with domestic REITs falling -0.1% for the month, while global REIT’s fell -4.0% on a fully hedged basis.

Fixed Interest (Bonds)

Global sovereign bond yields were generally up across the board in August with 10 year bond yields up in the UK (+25 bps to 2.60%) and Germany (+18 bps to 1.85%) experiencing largest gains.

Australian bond yields were also up over the month with 10 year bond yields rising +18bps to 3.9% and 2 year bond yields up +20bps to 3.2%.

Australian Dollar

The Australian dollar continued to depreciate against all major currencies in August. The A$ fell -0.8% against the US$, finishing August at US$0.891. The A$ also depreciated against the Euro (-0.1%), and the Pound Sterling (-2.7%).

Leave A Comment

You must be logged in to post a comment.