Director’s Comment

By Noel Hucker

Have you ever had a great teacher or mentor? Someone that has made a real difference to the way you think and conduct yourself? We inherently know that having a great teacher / coach / mentor can bring out the best in us and enable us to achieve things we may not have at first thought possible. And so too, having a trusted financial advisor can inject knowledge that will allow you to build and protect your wealth in ways you never thought possible. The quote below from Benjamin Franklin is as true today as it was when he said it nearly 300 years ago.

Part 3: Investing in a low interest rate environment

An investment in knowledge always pays the best interest.

~ Benjamin Franklin

This is the third, and final part, of our series of newsletters based on investing in the current low interest rate market. In this newsletter we will give some insights into Australian shares and listed property.

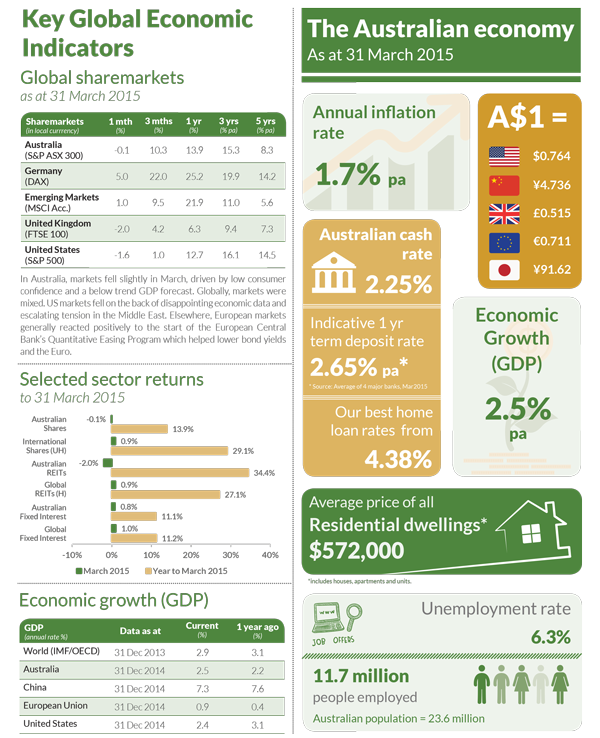

Australian shares

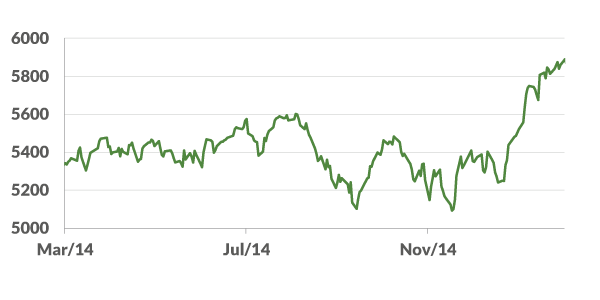

Shares can provide value both in terms of capital growth and dividend income. The Australian share market has recently been enjoying a rally, and has a one year return to 31 March 2015 of 13.9% (S&P ASX 300). However, it is important to remember that past performance is not a predictor of future performance.

A consequence of the positive share price growth is that the dividend yields has gone down (as the dividend paid is a smaller percentage of the share price). Currently the Australian share market is providing a dividend income return in the range of 4% to 4.5% per annum. If you add in the benefits of franking credits, the total return is in the range of 5.5% to 6% per annum. Yield for large companies with stable dividends tend to grow over time in line with, or above inflation. When investing over a period of 5-7 years the income return on Australian shares is expected to be significantly higher than the cash rate.

Australian Listed Property Trusts

Australian Listed Property Trusts (LPT’s) can also be an option for investors looking for both capital growth and income. Currently the Australian LPT market is providing dividend income returns in the range of 5% to 6% per annum, however, these investments generally do not provide franking credits like other shares. The appeal is based on the stability of LPT’s as yield from rent has proven to be very consistent. Again, the income return is expected to be significantly higher than the cash rate.

Keeping your investment portfolio on track

- One of the best ways to deal with investment risk and uncertain circumstances is to diversify your portfolio. This simply means you don’t put all your eggs into one basket. It is not possible to predict what will be the best performing asset class over the short to medium term. When investing in a low interest rate environment, it is best practice to diversify, that is spread investments across the asset types of Australian shares, international shares, property, fixed interest and cash.

- Portfolio rebalancing is like a tune up for your car, it will help maintain your investment strategy and mimimise risk. Usually once a year is sufficient. An imbalance in the allocation of assets may leave you overweight in a sector that is more risky and may not be in line with your personal risk-return tolerance level.

- Past performance is not always an indicator of future performance. Remaining heavily invested in last years ‘winning’ asset class could erode earnings if these assets don’t perform so well in the current year.

Of course, everyone’s personal situation is unique and this will impact on your investment choices. Should you find you would like some help to set up, maintain and / or grow your investment portfolio, call our office to speak to one of our experienced financial planners today. Getting sound financial advice can improve your financial outlook and help you reach your financial goals. The great news is that the benefits of advice also grow over time.

Click here to download a copy of this newsletter as a PDF.

Leave A Comment

You must be logged in to post a comment.