Director’s Perspective

By Mario Isaias

The May Federal Budget contained measures aimed at bringing our national accounts back into surplus (although this is not forecast to occur until 2019-2020). Although these first steps are necessary in order to bring about economic sustainability for Australia, the immediate reaction was to see a drop in confidence by consumers and businesses. The upcoming reporting season is key for the Australian economy – seeing how many companies meet, disappoint or exceed profit expectations is a key indicator as to how the market will perform for the rest of the calendar year. One potential issue could be inflation. July 2014 saw the annual rate of inflation reach 3% for the first time since January 2012 and has

thus now reached the upper threshold of the RBA’s target range. If inflation continues to rise, the Reserve Bank may consider raising interest rates to slow the economy and reduce inflation back to within their target range of between 2% – 3% pa.

Regional Commentary

Australia

Monetary policy – the Reserve Bank of Australia (RBA) left the cash rate unchanged at 2.5% at their July 2014 meeting for the tenth consecutive month. The annual rate of inflation rose 0.5% to 3.0% in the June quarter of 2014. It is now currently at the upper end of the RBA’s target range of 2% to 3% meaning that the RBA could raise the cash rate sooner than previously expected.

Retail – According to the Australian Bureau of Statistics data, Australian retail sales fell by 0.5% in May 2014. This was slightly below the adjusted April 2014 figure which saw retail sales fall by 0.1% for that month.

Employment – The Australian economy created 15,900 jobs in April 2014. Despite this increase however, the unemployment rate (seasonally adjusted) remained steady at 5.9% for the month.

Growth – The Australian GDP growth for the March quarter of 2014 was 1.1% taking annual GDP growth to 3.5% to the end of March.

Australian CPI Inflation

As at 31 May 2014

Source: RBA, ABS

United States

Growth – The annual GDP growth rate in the US for the March quarter 2014 was revised down further to an annual rate of -2.9%. The previous estimate had revised down the initial forecast of +0.1% pa to a lower figure of -1.0% pa. It is the first time that the US economy has contracted in three years.

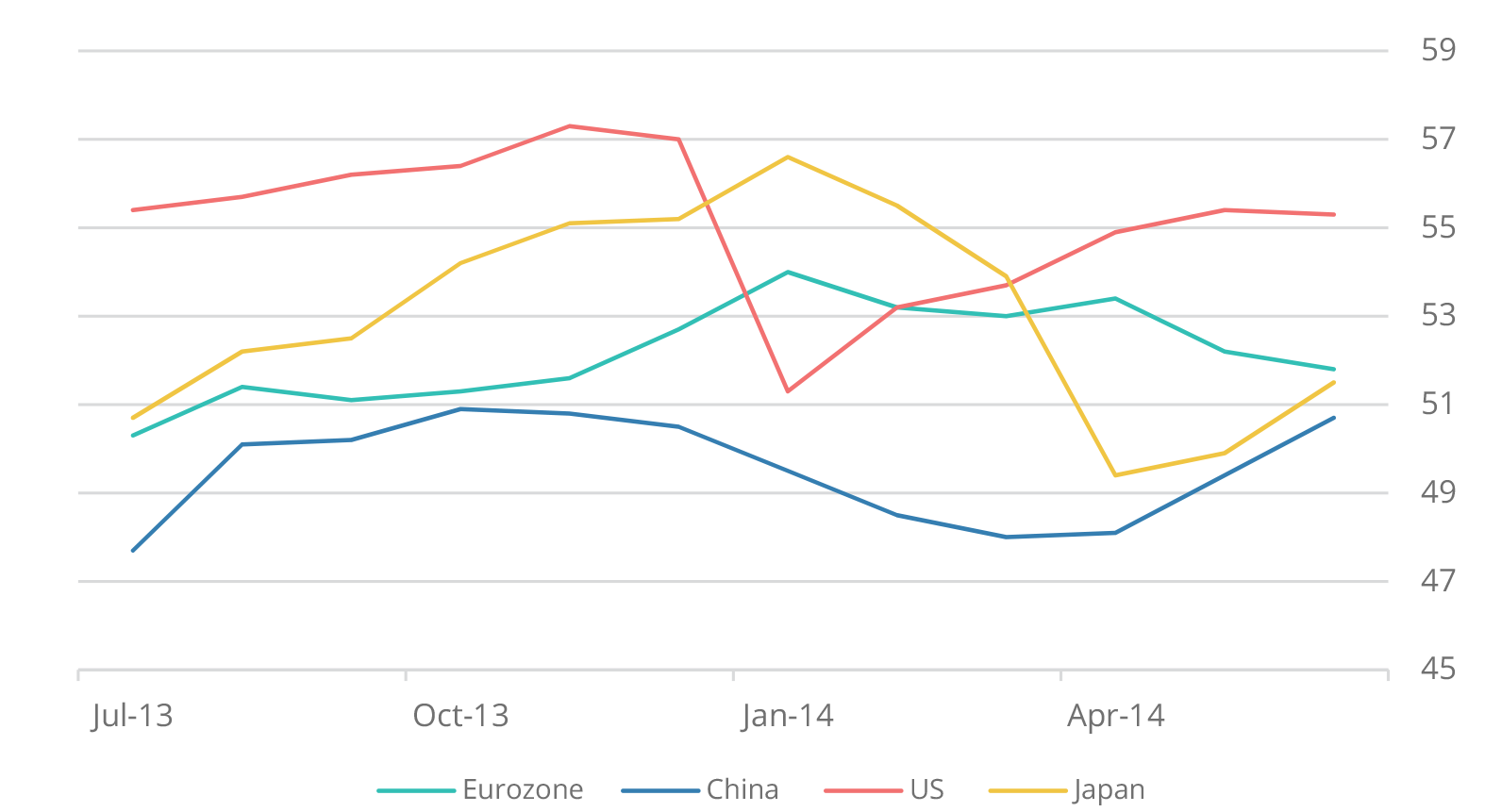

Manufacturing – The ISM Manufacturing PMI fell slightly to 55.3 in June 2014, down from 55.4 during the previous month.

Employment – The US unemployment rate fell 0.2% to 6.1% in June 2013 (down from 6.3% during the previous month). This was primarily driven by strong job growth in professional services, retail trade, food services and health.

Europe

Employment – The official Eurozone rate of unemployment fell slightly by 0.1% to 11.6% in May 2014 (down from 11.7% in April). It has thus fallen 0.4% in the 12 months since May 2013 (at which time it was 12.0%).

Manufacturing – Manufacturing within the Eurozone continued to improve for the twelfth consecutive month in June 2014. However the pace of improvement has recently begun to slow with the Eurozone Manufacturing PMI dropping to 51.8 (down 0.4 from 52.2 in the previous month).

China/Japan

Inflation – Chinese annual inflation finished the month of June 2014 at 2.3%. Although this was lower than the previous month’s result of 2.5% pa, and remains below their target rate of 3.5% pa in 2014, the positive overall growth result has continued to give investors confidence that China will be able to avoid entering a period of deflation.

Manufacturing – Manufacturing in China rose in June 2014. The HSBC China Manufacturing PMI reached 50.7 for the month (up from 49.4

in May) and signalled the first net growth in Chinese manufacturing since January 2014.

Manufacturing in Japan also increased in June with the Japanese manufacturing PMI rising to 51.5 for the month (up from 49.9 in May). This signals the first time that manufacturing output in Japan has improved since the introduction of a new sales tax in March 2014.

Selected Global Manufacturing PMI Indicators

As at 30 June 2014

Source: Datastream. Prepared by Harvest Financial Group

Commodity Prices

Commodity prices were generally stronger in June 2014. Gold prices rose 5.8% to finish the month at US$1,316.93/oz. Iron Ore prices also rose, increasing 2.2% to US$95.0 per metric tonne. The Oil price followed suit, finishing the month up 2.0% to US$112.79/bbl.

The Australian share market was weaker in June 2014. It felt the effects of profit warnings from a number of key retailers caused by weakening consumer confidence following the Federal Government’s May 2014 Budget. Our belief is that the market is still currently at fair value based on improved profit expectations for the 2014 financial year. We expect the Australian Equity market to continue to trade between 5,200 and 5,800 for the remainder of 2014.[/jbox]

The Australian share market was weaker in June 2014. It felt the effects of profit warnings from a number of key retailers caused by weakening consumer confidence following the Federal Government’s May 2014 Budget. Our belief is that the market is still currently at fair value based on improved profit expectations for the 2014 financial year. We expect the Australian Equity market to continue to trade between 5,200 and 5,800 for the remainder of 2014.[/jbox]

Asset Class Returns for Selected Market Indicators

As as 30 June 2014

Source: Thomson Financial Datastream; MSCI Data provided ‘as is’. Prepared by Harvest Financial Group

Selected Market Indicators Commentary

As at 30 June 2014

Australian Shares

The Australian share market fell -1.4% in June 2014 with negative returns posted across the market. Investors expressed concern over low consumer confidence which contributed to Australia’s trade balance returning to deficit.

The best performing sectors for the month of June 2014 were Utilities (+2.7%) and Property Trusts (+3.3%). The weakest performing sectors for the month were Consumer Staples (-4.5%) and Healthcare (-0.9%).

Global Shares

Global share markets were mixed in June 2014 with the MSCI World (ex. Australia) Index rising +1.7% on a fully hedged basis after investors drew confidence from growing manufacturing activity in the US, Europe and Asia.

The strongest performing global sectors for the month were Energy (+3.5%), Utilities (+2.0%) and Information Technology (+1.0%), while the weakest sectors were Industrials

(-0.7%) and Telecommunication Services (-1.5%).

Markets in the U.S. were positive with the S&P 500 Composite Index (+2.1%), the NASDAQ (+3.9%) and the Dow Jones (+1.2%) all up.

Conversely, European Markets were generally down in June 2014. Investors expressed concern over the continuing geopolitical conflict between Russia and Ukraine and the increasing sectarian violence in Iraq. Markets in the UK (-1.2%), France (-1.7%) and Germany (-1.4%) all recorded negative returns for the month.

Asian markets were generally up with the Indian BSE 500 (+6.4%) being the strongest performing while the Chinese Shanghai Composite Index (+1.3%) and the Japanese Topix (+5.3%) also made positive returns.

Property

Domestic Real Estate Investment Trusts (REITs) were up +3.3% in June 2014. Global REIT’s were also positive, returning +1.1% on a fully hedged basis.

Fixed Interest (Bonds)

Global sovereign bond yields were mixed in June 2014 with 10 year bond yields rising in the UK (+10bps to 2.67%) and the US (+6bps to 2.52%). 10 year bond yields fell in Germany (-6bps to 1.25%) and Japan (-1bp to 0.57%) over the month.

Australian bond yields were down in June with 10 year bond yields falling (-12bps to 3.54%), while Australian 5 year bond yields also fell(-12 bps to 2.99%).

Australian Dollar

The Australian dollar generally appreciated against most other major currencies in June. The A$ rose against the US$, finishing the month at US$0.944. The A$ also appreciated against the Euro (+0.8%) and the Japanese Yen (+0.8%). The notable exception was the Pound Sterling against which the A$ fell (-0.7%).

Click Here to download a PDF version of this newsletter

Leave A Comment

You must be logged in to post a comment.