Director’s Perspective

By Inbam Devadason

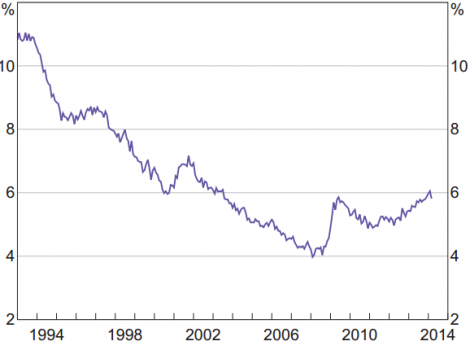

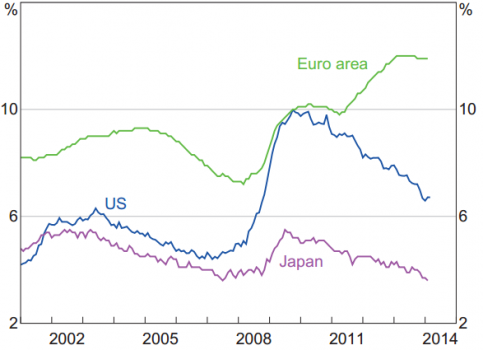

Global share markets were generally up around 1-2% over the month of April 2014 and have continued this upward trend in May 2014. Confidence is growing in the US recovery. The US Federal Reserve is reducing its bond buying program such that we expect it to finish by December 2014. Europe continues to improve with all their Purchasing Manufacturers’ Indices (PMI) now above 50 and signalling expansion. The unemployment graphs below show that employment is improving globally – particularly in the US and Japan. Australia has been focussed on the Abbot Government budget this month which will have a slight negative impact on Australian growth. This newsletter summarises some of the key economic indicators which generally point to an improvement in economic activity which is positive for equity markets. The key risk remains the continued reliance on central banks buying bonds and keeping official interest rates very low to boost economic activity. Any sharp increase in interest rates or inflation could constrain future growth. China’s faces some credit risk issues.

Regional Commentary

Australia

Monetary policy – the Reserve Bank of Australia (RBA) left the cash rate unchanged at 2.5% at their May 2014 meeting for the eighth consecutive month.

Retail – According to the Australian Bureau of Statistics data, Australian retail sales grew by 0.1% in March 2014. Although still positive the rate of growth has slowed substantially since the end of last year.

Employment – Employment increased in the Australian economy by 14,200 in April 2014. However, despite this, the unemployment rate (seasonally adjusted) remained steady at 5.8%.

United States

Growth – Initial indications show that the GDP growth rate increased by 0.1% for the March Quarter of 2014 brining the annual rate of GDP growth in the US to 2.7% (up from 2.6% pa in the December 2013 Quarter).

Manufacturing – The ISM Manufacturing PMI rose to 54.9 in April, up from 53.7 during the previous month.

Monetary policy – The US Federal Reserve confirmed that it would reduce its monthly asset purchase programme by an additional US$10 billion at its April/May 2014 meeting, decreasing the monthly asset purchase rate from $55 billion to $45 billion and signalling the Fed’s confidence that US economic growth will continue in line with expectations.

Employment – The US unemployment rate fell by 0.4% to 6.3% in April (down from 6.7% in March). This was primarily driven by the creation of 288,000 jobs during the month.

Europe

Employment – The official Eurozone rate of unemployment remained steady at 11.8%. It has been steady at this rate since October 2013.

Inflation – The European Central Bank (ECB) left rates on hold at 0.25% at their April 2014 meeting. In a positive sign for the Eurozone economy, the annual rate of inflation rose by 0.2% to 0.7% during April. However, this is well below the ECB’s target of around 2% and the ECB has indicated that it may look to cut interest rates in the future if conditions do not improve.

Manufacturing – Eurozone manufacturing rose slightly in April with the European Manufacturing PMI Index climbing to 53.4 (up from 53.0 in the previous month).

Unemployment Rate –

Australia

As at 30 April 2014

[jcol/]

Unemployment Rate –

Advanced Economies

As at 30 April 2014

[/jcolumns]China/Japan

Manufacturing – Chinese manufacturing rose slightly in April with the HSBC China Manufacturing PMI rising to 48.1 (up from 48.0 in March).

Inflation – Chinese annual inflation fell sharply in April to finishing the month at 1.8% (down from 2.4% during the previous month). There is increasing concern that China could experience a period of deflation in the future as its growth rate slows.

Commodity Prices

Commodity prices were generally weaker in April 2014. Gold prices fell 0.3% to finish the month at US$1,325.70/oz. Iron Ore prices also fell, dropping 6.1% to US$107.00 per million tonnes. The Oil price was the notable exception, finishing the month up 0.4% to $107.78/bbl

Asset Class Returns for Selected Market Indicators

As at 30 April 2014

Selected Market Indicators Commentary

For the Month Ended 30 April 2014

Australian Shares

The Australian share market was up in April returning +1.7% on the back of better than expected profit results revealed during the recent company reporting season.

The best performing sectors for the month of April 2014 were Property Trusts (+5.6%), Utilities (+3.4%) and Energy (+3.4%). The weakest performing sectors for the month were Healthcare (-1.4%) and Information Technology (-0.2%).

Global Shares

Global share markets were also positive in April 2014 with the MSCI World (ex. Australia) Index rising +1.0% on an un-hedged basis on the back of better than expected earnings results in the US.

The strongest performing global sectors for the month were Energy (+5.8%) and Consumer Staples (+3.1%). The weakest performing sectors in April 2014 were IT (-0.6%) and Consumer Discretionary (-1.0%).

Markets in the U.S. were mixed in April 2014 as the U.S. Federal Reserve confirmed that it

will further reduce its monthly bond buying program by $10b per month to US$45 billion. The NSADAQ was down -2.0% while the U.S. S&P 500 Composite Index was up by a modest +0.7% for the month.

European Markets followed the global trend and were generally up in April. Investors showed improved confidence in Eurozone markets on the back of a slight improvement in the annual rate of inflation and in anticipation of the Eurozone elections. Markets in the UK (+3.1%), France (+2.6%) and Germany (+0.5%) all recorded positive returns for the month.

Asian markets were mixed during the month of April with markets in India (+0.6%) being the strongest performing while the Chinese Shanghai Composite Index (-0.3%) and the Japanese Topix (-3.4%) were the weakest.

Property

Domestic Real Estate Investment Trusts (REITs) were up in April 2014 returning +5.6%. Global REIT’s were also up, gaining +3.0% on a fully hedged basis.

Fixed Interest (Bonds)

Global sovereign bond yields were down in April with 10 year bond yields falling in the UK (-7bps to 2.67%), the US (-8bps to 2.65%) and Germany (-10bps to 1.47%) over the month.

Australian bond yields were also down in April with 10 year bond yields falling (-14bps to 3.95%), while Australian 5 year bond yields fell (-11bps to 3.33%).

Australian Dollar

The Australian dollar generally appreciated against most other major currencies in April. The A$ rose against the US$, finishing the month at US$0.927. The A$ also appreciated against the Euro (+0.3%) and the Japanese Yen (+0.3%) while it fell -0.3% against the Pound Sterling.

[jbox vgradient=”#d8d8d8|#ffffff” shadow=”7″ jbox_css=”border:4px solid #9d9d9d;” title=”General Advice Warning“]© 2014 Harvest Employee Benefits. This Newsletter has been prepared for Harvest’s clients. The information contained herein is current and up to date at the time it was prepared. Harvest Employee Benefits Pty Ltd, ABN 74 107 226 693 is a Corporate Authorised Representative and Mario Isaias, Noel Hucker and Inbam Devadason are Authorised Representatives of Harvest Financial Group Pty Ltd, ABN 80 111 998 068 AFS Licence No 284909. Harvest reserves the right to correct any errors or omissions. Any advice contained herein has been prepared without taking into account any individual persons objectives, financial situation or needs. As such, before acting on any information contained herein, a person should consider whether the information is appropriate for that person, having regard to their objectives, financial situation and needs. The relevant Product Disclosure Statement should be obtained and read before making any decision regarding information contained in this Newsletter[/jbox]

Leave A Comment

You must be logged in to post a comment.