Director’s Perspective

By Mario Isaias

Welcome to the New Year and I trust you had a wonderful festive season with family and friends. The previous calendar year will be remembered as one of the better investment years. With low interest rates and central bank support, most markets performed very well, led by the U.S. – still the world’s largest economy. The U.S. market’s S&P 500 Index returned +29.5% for the calendar year, outperforming our own ASX 300, which returned +19.7% (our best return since 2009). Returns for the year from other major share markets, including Germany (+25.5%), Japan (+56.7%) and France (+18.0%) were also impressive. Most investors should have seen their share portfolios and super grow in 2013.

We now turn to 2014 and consider how markets may perform. We expect that 2014 may not be as good a year given that the U.S. Federal Reserve has announced that it will begin tapering its support of the economy in January, China’s economic activity is moderating and Europe’s economic recovery likely to continue to proceed at a subdued rate. In Australia, our growth is expected to be sluggish given the slowing of the mining boom, the continued shrinkage of manufacturing and a weakening government fiscal budget outlook. A lower Aussie dollar and low interest rates are expected to counteract this to some extent by stimulating consumer spending and housing construction. Overall, we would expect that the Australian share market will return in the region of +8% to +10% for the 2014 calendar year. Wishing you all the best in 2014.

![]()

Regional Commentary

Major Economic Factors

Australia

Monetary policy – the Reserve Bank of Australia (RBA) did not meet in January 2014, and thus the cash rate remained unchanged at 2.5%. Given that the A$ is continuing to depreciate against other major currencies, we believe the RBA is likely to keep the cash rate on hold for the moment.

Inflation – the Australian Consumer Price Index (CPI) rose 0.8% for the quarter and 2.7% for the year ending 31 December 2013; still within the RBA’s 2-3% target band.

Employment – The Australian economy lost 22,600 jobs during the month of December. The unemployment rate rose 0.1% to 5.8%.

Europe

Growth – The European economy continues to show signs of improvement. The European Central Bank (ECB) is forecasting a return to growth for the Eurozone with GDP expected

to increase by 1.1% in 2014, after contracting 0.4% for the year ended 31 December 2013. Eurozone GDP growth is expected to further increase into 2015.

Manufacturing – Eurozone manufacturing continued to recover in December 2013 with the Manufacturing Index reaching 52.7, its highest result in 31 months.

Monetary policy – Eurozone inflation continued to fall and remains significantly below the ECB’s target rate. Concerns are beginning to surface that the Eurozone may be entering into a period of deflation and although it left interest rates on hold at its last meeting, it has signalled it may look to lower them in the near future if inflation continues to fall.

[jcol/]

United States

Growth – US GDP growth for the September 2013 quarter was revised up to 4.1% from an earlier estimate of 3.6%. It is expected to remain positive in final quarter of 2013.

Manufacturing – The ISM Manufacturing PMI index softened in December, falling to 57.0 (down from 57.3 in October).

Monetary policy – the US Federal Reserve announced that it would begin tapering its Quantitative Easing programme in January 2014. The Federal Reserve stated that it plans to cut its bond purchasing by US$10 billion per month from US$85 billion and has indicated that it is likely to further reduce its monthly purchases at subsequent meetings.

China/Japan

Growth – China’s annual GPD growth fell slightly to 7.7% in the December 2013 quarter (down from 7.8% in the September 2013 quarter).

Manufacturing – Chinese manufacturing softened in December with the HSBC China Manufacturing PMI falling to 50.5 in October (down from 50.8 in November).

Employment – Japanese unemployment remained steady at 4.0% as at 30 November, having been at this level since September.

Commodity Prices

Commodity price movements were mixed in December 2013. Iron Ore was flat at US$137/MT, oil was up 0.1% to $111.39, while gold was down 3.6% to US$1,207.85.

[/jcolumns]Monthly Manufacturing Index to November 2013

The Australian share market continued to stabilise in December 2013. The market resisted a predicted fall in the wake of the announcement by the U.S. Federal Reserve that it would begin tapering its monthly bond buying programme in January 2014. Our belief is that the market is currently at fair value based on profit expectations for the 2014 financial year. We expect the Australian Equity market to continue to trade in the range of 5,000 to 5,500 over the next 6 months.

[/jbox]

![]()

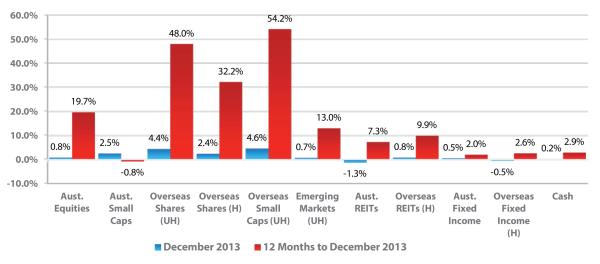

Asset Class Returns for Selected Market Indicators

As at 31 December 2013

Australian Shares

Australian shares made a modest positive return in December 2013, with the Australian share market gaining +0.8% for the month on the back of positive job growth data showing that the Australian economy added 21,000 jobs the previous month in November .

The best performing sectors for the month of December 2013 were Telecommunication Services (+4.3%), Energy (+3.3%) and Industrials (+2.6%). The weakest performing sectors for the month were Property Trusts

(-1.3%), Financials (ex. Property Trusts) (-1.0) and Information Technology (+0.7%).

Global Shares

Global share markets were also generally up over the month of December 2013 with the MSCI World (ex. Australia) Index returning +4.4% on an unhedged basis.

The strongest performing global sectors for the month were Information Technology (+6.5%) and Industrials (+5.4%), while Consumer Staples (+2.9%) and Utilities (+2.5%) performed the weakest.

Markets in the U.S. continued to make positive returns in December despite the U.S. Federal Reserve’s announcement that it would begin to taper its Quantitative Easing program beginning in January 2014. Both the NSADAQ (+2.9%) and the U.S. S&P 500 Composite Index (+2.5%) were up for the month.

Although also making positive returns, markets in Europe underperformed their U.S counterparts with

[jcol/]the German DAX 30 and the UK FTSE 100 being the strongest performers, both up +1.6% in December 2013.

Asian markets were mixed in December with the Japanese TOPIX (+3.6%) being the strongest performer, while the Chinese Shanghai Composite Index (-4.7%) was the weakest performing Asian market.

Property

Domestic Real Estate Investment Trusts (REITs) were down in December returning

-1.3% for the month, while global REIT’s were up, gaining +0.8% on a fully hedged basis.

Fixed Interest (Bonds)

Global sovereign bond yields were generally up in December with 10 year bond yields in the UK (+26bps to 3.03%), the US (+25bps to 3.01%) and Germany (+25bps to 1.94%) experiencing the largest gains for the month.

Australian bond yields recorded mixed results in December 2013 with 10 year bond yields increasing +11bps to 4.23%, while Australian 5 year bond yields fell slightly by -1bps to 3.43%.

Australian Dollar

The Australian dollar generally continued to depreciate against other major currencies in December 2013. The A$ fell 2.1% against the US$, finishing the month at US$0.895. The A$ also depreciated against the Euro (-3.3%) and the Pound Sterling (-3.2%).

[/jcolumns]![]()

GENERAL ADVICE WARNING

© 2014 Harvest Employee Benefits. This Newsletter has been prepared for Harvest’s clients. The information contained herein is current and up to date at the time it was prepared. Harvest Employee Benefits Pty Ltd, ABN 74 107 226 693 is a Corporate Authorised Representative and Mario Isaias, Noel Hucker and Inbam Devadason are Authorised Representatives of Harvest Financial Group Pty Ltd, ABN 80 111 998 068 AFS Licence No 284909. Harvest reserves the right to correct any errors or omissions. Any advice contained herein has been prepared without taking into account any individual persons objectives, financial situation or needs. As such, before acting on any information contained herein, a person should consider whether the information is appropriate for that person, having regard to their objectives, financial situation and needs. The relevant Product Disclosure Statement should be obtained and read before making any decision regarding information contained in this Newsletter.

Click Here to download a pdf of this newsletter.

Leave A Comment

You must be logged in to post a comment.