Welcome to Harvest’s first Investment Newsletter for 2015. We hope you enjoyed your break and have returned to work refreshed and ready to go!

In this newsletter, we’ll be summarising market movements over December whilst concentrating mainly on how calendar year 2014 finished up and most importantly, how we think markets in 2015 are likely to pan out; both here and abroad. One thing will be certain. Above-normal volatility will be ever present and those with access to meaningful market insight will navigate choppy waters best. We hope our insights will help crystalize your thinking so together, we can make investment decisions optimally suited to your goals, objectives and tolerance to risk.

2014 in review

Volatility was a constant over the best part of 2014 as the Australian market was affected by falling commodity prices, lower volume growth from a slowing Chinese economy and Australian fiscal challenges.

The big story at the end of the year was the sharp fall in oil prices. Historically, the knock-on effects of lower oil prices have generally been positive for Western economies. This is because energy prices affect all goods and services and the fall in oil could reinforce the trend for the general price level to fall further. However, the falling oil price remains a challenge for investors in energy stocks, and for Australian mining companies.

A hallmark of 2014 was that the Australian stock market had the highest number and value of initial public offerings (IPOs) for many years. Some of these did spectacularly well for initial investors, whilst others have performed poorly since listing. A big IPO during the year was Medibank Private, with a market cap well in excess of $5Bn. At the close of 2014, Medibank Private had gained 20.5% from the initial price.

Overseas, the US market did well with the S&P500 composite gaining 11% in the during the year. The FTSE 100 finished the year down by 2.71%, its first annual loss since 2011. The Shanghai Composite Index was up more than 52% for the year, making it the world’s top-performing major equity market.

Looking ahead to 2015

At Harvest we see the following positives in the Australian economy for 2015:

- The falling dollar will help our exporters and those who derive much of their revenue from overseas.

- The falling oil price, and energy prices more broadly, will cut the cost of doing business (e.g. production and transport costs).

- GDP is currently below the long term trend but not too bad – at 2.7% year on year to end November, 2014.

- Overall the Australian share market looks to be fair value.

- Migration will continue to underpin consumer demand and housing.

- Inflation remains well within the RBA’s 2-3% target band.

- Wages growth is benign which will keep inflation low and help business control costs.

- Globally, during 2015, we expect to see the following;

- The US Economy will continue to grow strongly.

- China’s economic growth to slow but be in line with the Government’s target of 7.5% pa.

- Japan to gradually recover from it’s current recession.

- Europe will be patchy but continue to grow at a modest pace.

- The Indian economy to continue to grow strongly.

Harvest’s view

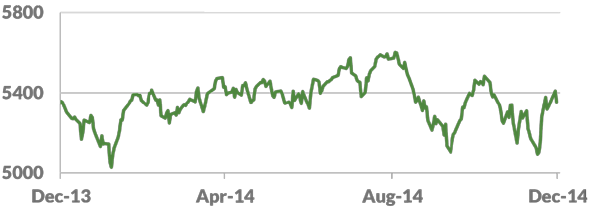

The Australian share market returned to positive territory after being down in November, with the S&P / ASX 300 up +2.0% in December 2014. Our belief is that the market is still at fair value. We expect the Australian Equity market (as measured by the ASX 300) to trade at between 5,200 and 5,800 throughout 2015.

S&P/ASX300 Index

1 year price history to 31 December 2014

Click here to download a PDF of this newsletter

Leave A Comment

You must be logged in to post a comment.