Investment Newsletter – October 2012

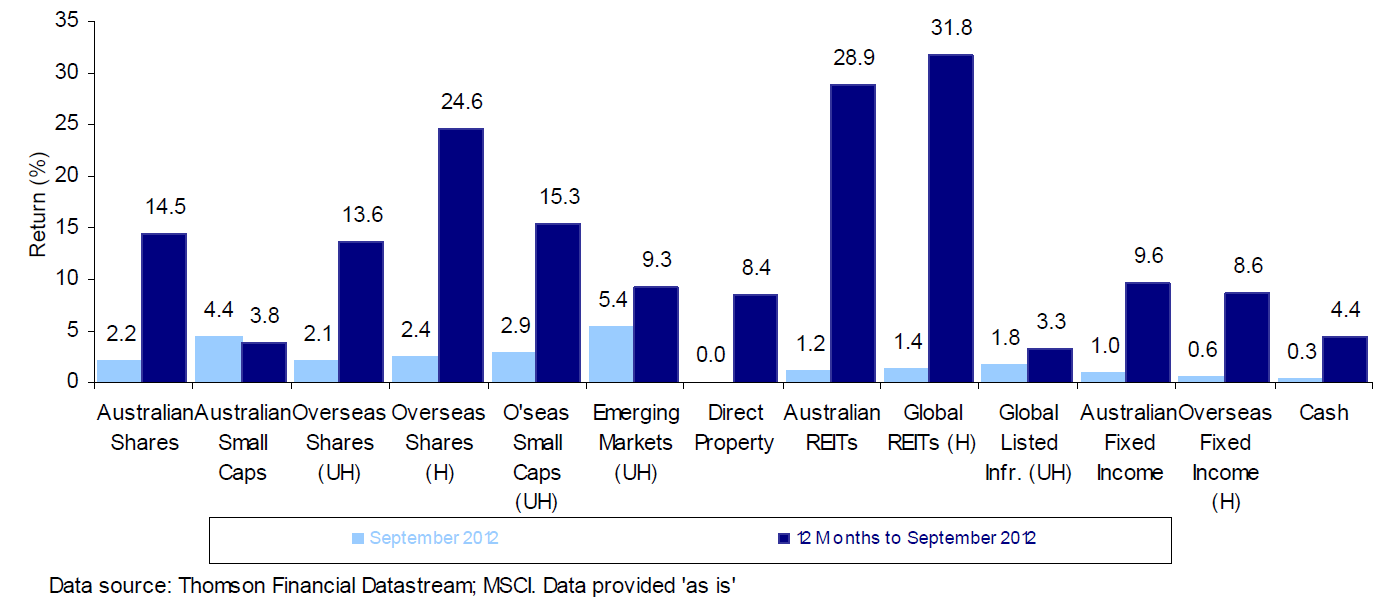

Global share markets have performed strongly for the quarter ending 30 September 2012. Some key developments influencing markets at the moment include: Australian Cash Rate The Reserve Bank of Australia (RBA) has dropped the official cash rate to 3.25% pa mainly due to a softening global economic outlook, slowing growth in China (and the developing world), and the need to stimulate the non-mining sectors of the Australian economy.