Australian House prices enjoyed a very strong boom over the last 20 years (with some moderation during the Global Financial Crisis

Some key statistics on Australian house prices at the moment include:

- Prices on average have fallen by around 6% since their peak in 2010

- High house prices are high on a variety of measures (see below)

- High levels of household debt

- Housing representing 60% of Australian household wealth

- Housing loans representing 59% of total private credit

How should Australian house prices be valued?

We have reviewed a broad range of different measures to provide an indication of the overall state of the residential housing market in Australia.

House prices to income ratio

The OECD reports that the ratio of house prices to incomes in Australia is 28% above its long term average – putting Australia at the top end of OECD countries. Canadian and some Northern European countries are even higher above the long term average – see graph below for details.

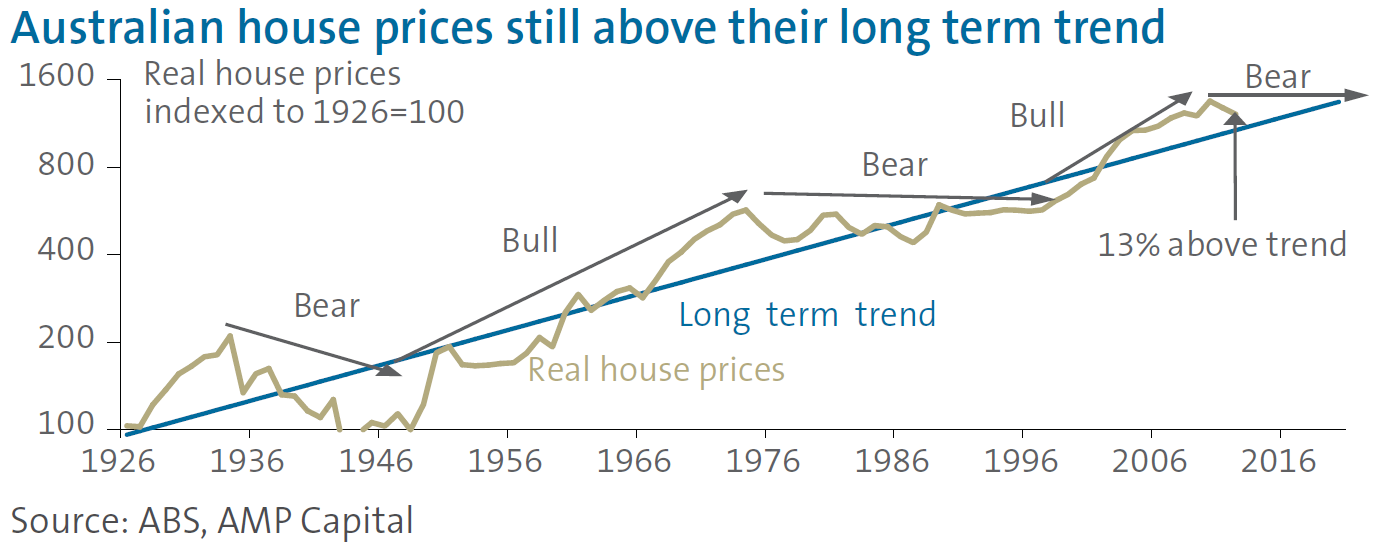

House prices relative to long term trend

Australian real house prices are currently around 13% above their long term trend – see graph below.

Property Price Earnings Ratio

A Price Earnings ratio is effectively the ratio of prices to rents (adjusted for inflation). On this measure, Australian house values are around 10% above their long term trend.

Housing as an Investment

Residential property has historically provided a similar return to shares over the long term (around 11% pa since the 1920’s). At the moment, the gross rental yield on residential property is around 3.7% pa, compared to 7% on unlisted commercial property, 6% for listed property and 6.5% for Australian shares (including franking credits). The income return for residential property is significantly below other Australian growth assets; indicating this asset class is more expensive in relative terms.

Housing Supply

The National Housing Supply Council estimates a cumulative shortfall of more than 200,000 dwellings in Australia. The Australian Bureau of Statistics in 2011, reduced Australian population estimates by around 300,000; suggesting the housing undersupply may not be so significant. Australia does have low vacancy rates which confirms that there is an overall undersupply of housing which is supportive for house prices. See vacancy rate chart below.

Residential auction clearance rates and Finance approvals

Finance approvals and new home sales are currently at cyclically low levels (despite some new home purchase incentives from the Government).

Auction clearance rates in Sydney and Melbourne are also at very low levels despite recent cuts in the Reserve Bank official interest rate (see chart below for details).

Australian House Price Outlook

We expect that the poor affordability, overvaluation and high household debt levels have put a cap on house prices for the moment. The undersupply is likely to currently limit the downside risk in the short term. In addition, the recent drop in official interest rates will also provide some support to prices at current levels. Some downside risks remain if Australian unemployment rises or if property investors, impatient for gains, decide to sell their properties; thereby putting downward pressure on prices.

GENERAL ADVICE WARNING © 2012 Harvest Financial Group Pty Ltd. This Newsletter has been prepared for clients of Harvest. This document contains confidential and proprietary information of Harvest Financial Group (‘Harvest’), and is intended for the exclusive use of the recipient to whom it is addressed. The document, and any opinions on investment products it contains, may not be modified, sold or otherwise provided, in whole or in part, to any other person or entity without Harvest’s prior written permission. Information on investment management firms contained herein has been obtained from the firms themselves and other sources. While this information is believed to be reliable, no representations or warranties are made as to the accuracy of the information presented, and no responsibility or liability, including for consequential or incidental damages, can be accepted for any error, omission or inaccuracy in this report or related materials. Opinions on investment products contained herein are not intended to convey any guarantees as to the future investment performance of these products. In addition, past performance cannot be relied on as a guide to future performance. This information has been sourced from Harvest’s independent research house Mercer Investment Consulting Research and other sources.

Leave A Comment

You must be logged in to post a comment.