![]()

Director’s Perspective

By Noel Hucker

There’s a great saying about seeing the forest for the trees and it’s easy to fall into this trap when there is so much information and news out there – Russia and Crimea/Ukraine, Chinese production, tapering of the US Federal Reserve’s Quantitative Easing programme, etc. etc.

Issues like these have always been there and always will be. For companies, it’s all about how you manage and navigate through these issues to ensure that you are doing the best you can for your customers and stakeholders – it always has been this way and it always will be. While there is a lot of detail and analysis below, let us not forget to see the forest for the trees.

![]()

Regional Commentary

Monetary policy – the Reserve Bank of Australia (RBA) left the cash rate unchanged at 2.5% at their March 2014 meeting for the seventh consecutive month. We believe the RBA is likely to continue to keep the cash rate on hold for the moment.

Inflation – The RBA revised up its short term inflation forecasts announcing that it now expected inflation to reach 3% over the year to June 2014.

Employment – Employment increased in the Australian economy by 47,400 in February 2014. However, despite this, unemployment rate in still rose 0.1% to 6.0% for the month.

United States

Growth – The US annual GDP growth rate for the December 2013 Quarter had previously been estimated at 3.2% however the official rate for the quarter came in lower at 2.4%.

Manufacturing – The ISM Manufacturing PMI rose to 53.2 in February, up from 51.3 during the previous month.

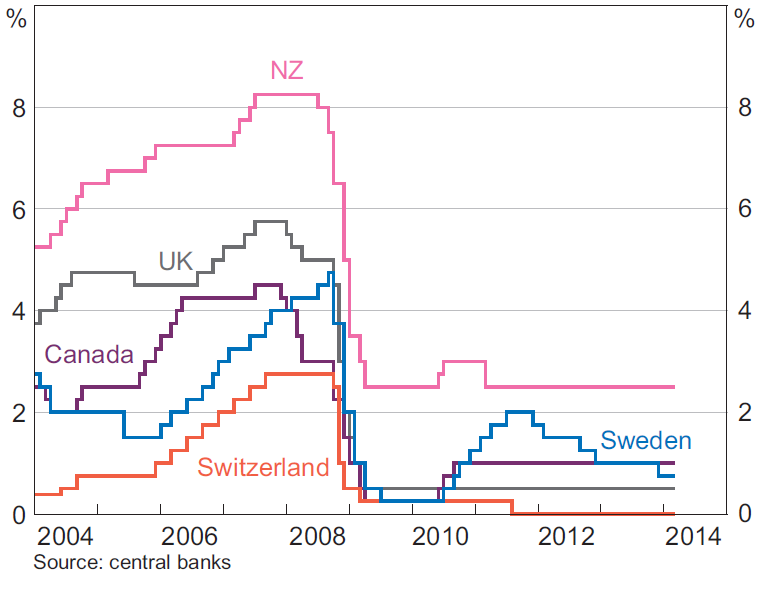

Monetary policy – The US Federal Reserve announced a further reduction of $10 billion per month to its monthly asset purchase programme, decreasing the monthly asset purchase rate from $65 billion to $55 billion. It also announced that it would continue to hold interest rates at near 0%.

Employment – The US unemployment rate rose by 0.1% to 6.7% for the month despite creating 175,000 new jobs. The participation rate remained steady at 63.0% for the month.

Europe

Growth – Eurozone GPD growth increased by 0.3% for the fourth quarter of 2013 and is expected to further increase during 2014.

[jcol/]Manufacturing – Eurozone manufacturing continued to expand in February however the rate of expansion fell to 53.2 (down from 54.0 in the previous month).

Inflation – The European Central Bank (ECB) left rates on hold at 0.25% for the month

despite a downgrade of their 2014 annual inflation estimate to just 1.2%. The ECB has signalled in may look to cut rates at its next meeting.

Employment – Eurozone unemployment remained stubbornly high at 12.0% for the month of February 2014. It has been steady at this rate since October 2013. Unemployment rates across the Eurozone are spread between Austria (at 4.9%) and Greece (at 27.5%).

China/Japan

Growth – The Japanese annual GDP growth rate came in lower than expected for the December 2013 quarter at 1.0%

Manufacturing – Chinese manufacturing softened in December with the HSBC China Manufacturing PMI falling to 48.5 in February, down from 49.5 in January.

Inflation – Chinese inflation remained low throughout January 2014 with the Chinese consumer price index rising by 2.5% in the year to 31 January 2014.

Commodity Prices

Commodity prices were generally stronger during February 2014. The Oil price was up 1.2% to $109.29/bbl, Gold prices were also up 6.7% to US$1,325.70/oz. Iron Ore prices were the notable exception, dropping 6.3% to US$119.00/MT, which is a 7 month low.

[/jcolumns]

![]()

Asset Class Returns for Selected Market Indicators

As at 28 February 2014

Australian Shares

The Australian share market was up in February returning +4.9% on the back of better than expected profit results revealed during the recent company reporting season.

The best performing sectors for the month of February 2014 were Consumer Discretionary (+6.8%), Information Technology (+6.3%) and Energy (+5.7%). The weakest performing sectors were Telecommunications Services (+1.4%) and Healthcare (+2.9%).

Global Shares

Global share markets also had a generally good month in February 2014 with the MSCI World (ex. Australia) Index rising +4.3% on a fully hedged basis on the back of data which continues to indicate gradual but steady growth in the Europe.

The strongest performing global sectors for the month were Healthcare (+4.3%) and Materials (+3.7%), while Telecommunications Services (+0.2%) and Financials (-3.7%) were the weakest performing sectors.

Markets in the U.S. followed the global trend, also finishing the month of February higher despite the U.S. Federal Reserve announcing that it would taper it’s bond buying programme by an additional $10 billion per month. Both the NSADAQ (+5.0%) and the U.S. S&P 500 Composite Index (+4.6%) were up for the month.

European markets were also up despite continuing concern surrounding the potential flow on effects of

[jcol/]the weaknesses in emerging markets and the rising geopolitical tensions between the Ukraine and Russia. Markets in the UK (+5.0%), France (+5.8%) and Germany (+4.1%) were all up for the month.

Asian markets followed suit and were also generally up for the month with markets in India (+2.8%) and China (+1.1%) being the strongest performing.

Property

Domestic Real Estate Investment Trusts (REITs) were up in February returning +4.3%, while global REIT’s were also up, gaining +3.6% on a fully hedged basis.

Fixed Interest (Bonds)

Global sovereign bond yields were mixed in February with 10 year bond yields rising in the UK (+1bps to 2.72%) and falling in the US (-1bps to 2.66%) and Germany (-4bps to 1.53%) over the month.

Australian bond yields were up in February 2014 with 10 year bond yields rising +2bps to 4.02%, while Australian 5 year bond yields remained steady at 3.29%.

Australian Dollar

The Australian dollar generally appreciated against other major currencies in February 2014. The A$ rose 2.1% against the US$, finishing the month at US$0.895. The A$ also appreciated against the Euro (+1.0%) and the Pound Sterling (+0.8%).

[/jcolumns]

Leave A Comment

You must be logged in to post a comment.