Director’s Perspective

By Inbam Devadason

Global share markets have continued to trend upwards, with some stabilisation over the month of November 2013. Global economic growth has improved over the last 6 months and in particular, even Europe has returned to modest growth.

In Australia, business and consumer confidence levels have improved over the last 3 months. The Australian employment market, however, has remained of concern.

This newsletter summarises some of the key economic indicators which generally point to an improvement in economic activity which is positive for equity markets. The key risk remains the continued reliance on central banks buying bonds and keeping official interest rates very low, to boost economic activity. Any sharp increase in interest rates could constrain future growth.

Regional Commentary

Major Economic Factors

Australia

Monetary policy – the Reserve Bank of Australia (RBA) kept the official cash rate at 2.5% in November and we expect this may be the bottom of the interest rate cycle based on recent upward pressure on property prices.

Inflation – the Australian Consumer Price Index (CPI) rose 1.2% for the quarter and 2.2% for the year ending 30 September 2013; well within the RBA’s 2-3% target band.

Employment – The Australian economy added a modest 1,100 jobs during the month of October. The unemployment rate remained at 5.7%.

Europe

Growth – Spain (which accounts for 8% of Europe’s GDP) posted 0.1% growth over the quarter ending 30 September 2013; ending a 2 year recession in that economy. The UK economy grew at its fastest rate in more than 2 years, led by consumer spending and construction, despite concern over falling exports.

Manufacturing – Eurozone manufacturing expanded for the 4th consecutive month with the Manufacturing PMI index up to 51.3 in October 2013.

Monetary policy – a persistent low inflation rate of 0.7% pa in October resulted in Europe’s central bank reducing the official cash rate by an extra 0.25%, to 0.25% pa.

United States

Growth – US economic growth for the quarter ended 30 September 2013 was 2.8% pa, driven by strong growth in manufacturing activity.

[jcol/]Employment – the US economy added 204,000 new jobs in October 2013. The unemployment rate was higher at 7.3%, mainly reflecting temporarily unemployed government workers due to US debt ceiling issues.

Manufacturing – The Manufacturing PMI index remains positive and rose to 56.4 in October 2013 (up from 56.2 in September).

Monetary policy – the US Federal Reserve decided not to “taper” its QE policy (i.e. reduce the level of Government Bond buying). This, and the appointment of a new, ‘dove-ish’ Federal Reserve Chairman in Janet Yellen, should assist the continued recovery of the US economy.

China/Japan

Growth – China’s annual GPD growth increased to 7.8% pa in the quarter ended 30 September 2013. This was the fastest quarterly growth in the last 12 months.

Manufacturing – Chinese manufacturing continued to grow over October with the HSBC China Manufacturing PMI rising to 50.9 in October (up from 50.2 in September).

Employment – strong Japanese economic growth reduced the unemployment rate to 4.0% in September 2013 (down from 4.1% in August 2013).

Commodity Prices

Commodity prices softened over October 2013. Iron Ore was down 0.7% to US$133/MT, oil down 0.3% to $107.68 and gold down 0.5% to US$1,323.61.

[/jcolumns]

Monthly Manufacturing Index to October 2013

The Australian share market has risen strongly this year and has stabilised in November 2013. The market has been buoyed by a general improvement in global economic conditions and the deferral of US tapering of Federal Reserve bond buying. Our belief is that the market is now slightly overvalued based on profit expectations for the 2014 financial year. We expect the Australian Equity market to continue to trade in the range of 5,000 to 5,500 over the next 3 months.

[/jbox]

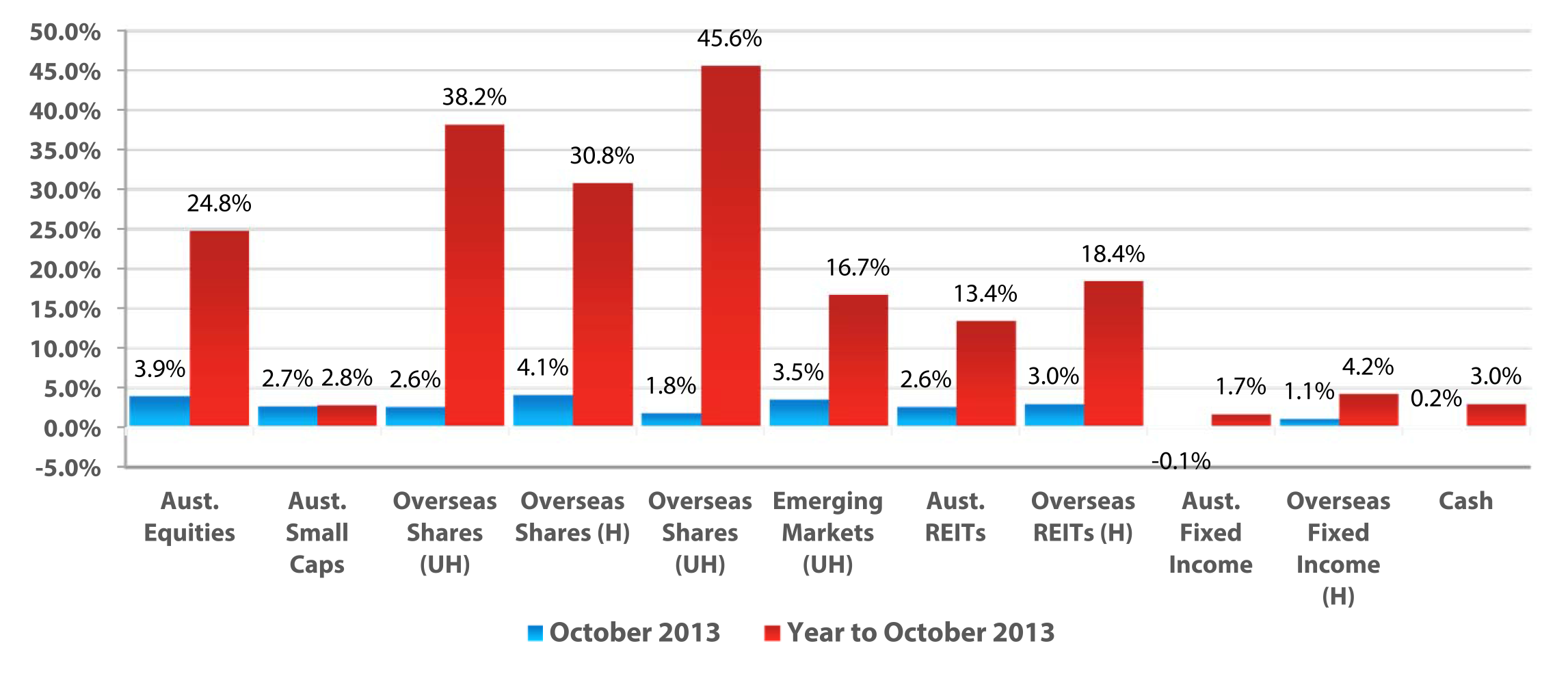

Asset Class Returns for Selected Market Indicators

As at October 31 2013

Australian Shares

Australian shares performed well in October returning +3.9% for the month. The best performing sectors for the month were Financials (+5.9%), Healthcare (+4.5%) and Telecommunications Services (+4.2%). The weakest performing sectors in October were Energy (+0.2%), Utilities (+1.1%) and Industrials (+1.9%).

The strong performance of Australian shares was primarily driven by banking stocks with ANZ (+10.4%) and the Commonwealth Bank (+6.8%) being the standout performers for the month.

Global Shares

Global share markets were also generally up over the month of October with the MSCI World ex. Australia Index returning +4.1% in local currency terms. The strongest performing global sectors for the month were Telecommunications Services (+5.4%) and Consumer Staples (+3.3%), while the weakest performing global sectors in October were Materials (+1.1%) and Utilities (+1.9%).

Markets in the U.S. performed strongly in October with investor confidence buoyed by the Federal Reserve’s decision to continue its monthly asset purchases at the current rate of $85 billion and the appointment of Janet Yellen as Federal Reserve Chairman. Both the NSADAQ (+3.9%) and the U.S. S&P 500 Composite Index (+4.6%) were up in October.

European markets were also up in October with the German DAX 30 being the strongest performer, up +5.1%.

[jcol/]

Other European markets including the French CAC 40 (+3.8%) and the UK FTSE 100 (+4.3%) were also up for the month.

Asian markets were mixed in October with the Indian BSE 500 returning +9.1%, while the Chinese Shanghai Composite Index was down -1.5% for the month.

Property

Real Estate Investment Trusts (REITs) performed well in October with domestic REITs returning +2.6% for the month, while global REIT’s gained +3.0% on a fully hedged basis.

Fixed Interest (Bonds)

Global sovereign bond yields feel across the board in October with 10 year bond yields in the US (-7 bps to 2.54%) and Germany (-5 bps to 1.68%) experiencing the largest losses. UK 10 year bond yields however bucked the global trend finishing the month up +9bps to 2.62%.

Australian bond yields also overcame the global trend in October with 10 year bond yields increasing +13bps to 3.94% and 5 year bond yields up +16 bps to 3.33%.

Australian Dollar

The Australian dollar continued to appreciate against all major currencies in October. The A$ rose +1.3% against the US$, finishing the month at US$0.947. The A$ also appreciated against the Euro (+0.8%), and the Pound Sterling (+2.1%).[/jcolumns]

GENERAL ADVICE WARNING

© 2013 Harvest Employee Benefits. This Newsletter has been prepared for Harvest’s clients. The information contained herein is current and up to date at the time it was prepared. Harvest Employee Benefits Pty Ltd, ABN 74 107 226 693 is a Corporate Authorised Representative and Mario Isaias, Noel Hucker and Inbam Devadason are Authorised Representatives of Harvest Financial Group Pty Ltd, ABN 80 111 998 068 AFS Licence No 284909. Harvest reserves the right to correct any errors or omissions. Any advice contained herein has been prepared without taking into account any individual persons objectives, financial situation or needs. As such, before acting on any information contained herein, a person should consider whether the information is appropriate for that person, having regard to their objectives, financial situation and needs. The relevant Product Disclosure Statement should be obtained and read before making any decision regarding information contained in this Newsletter.

Click Here to download a PDF Version of this newsletter

Leave A Comment

You must be logged in to post a comment.