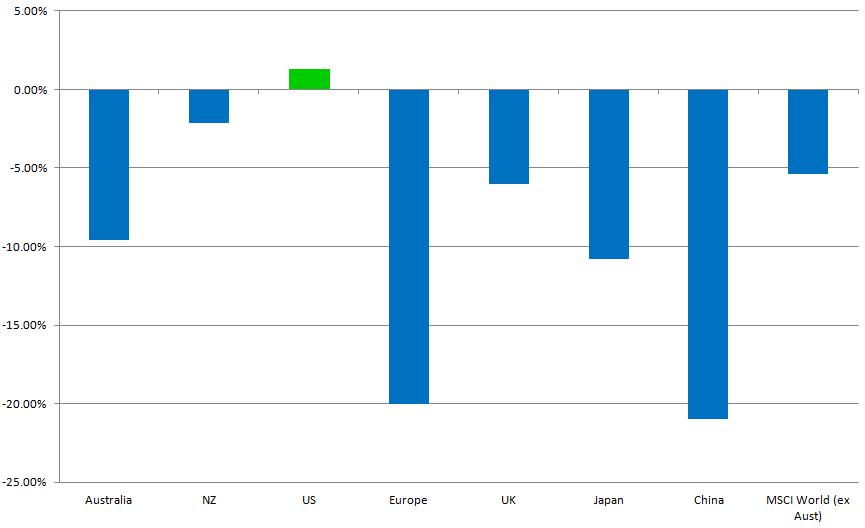

A tough year for shares

The last financial year has been a disappointing one for both global and Australian shares. For the 12 months to 30 June 2012, global shares returned -5.4% (MSCI World (ex Aust) $A; source: AMP Capital Markets), while Australian shares again underperformed global shares returning -9.6% (S&P/ASX200 Accum Index; source: AMP Capital Markets) over the same