September was a subdued month for shares with market jitters driven by the fierce US political campaign, continued US/China confrontation, Brexit negotiations and the wait for a COVID-19 vaccine.

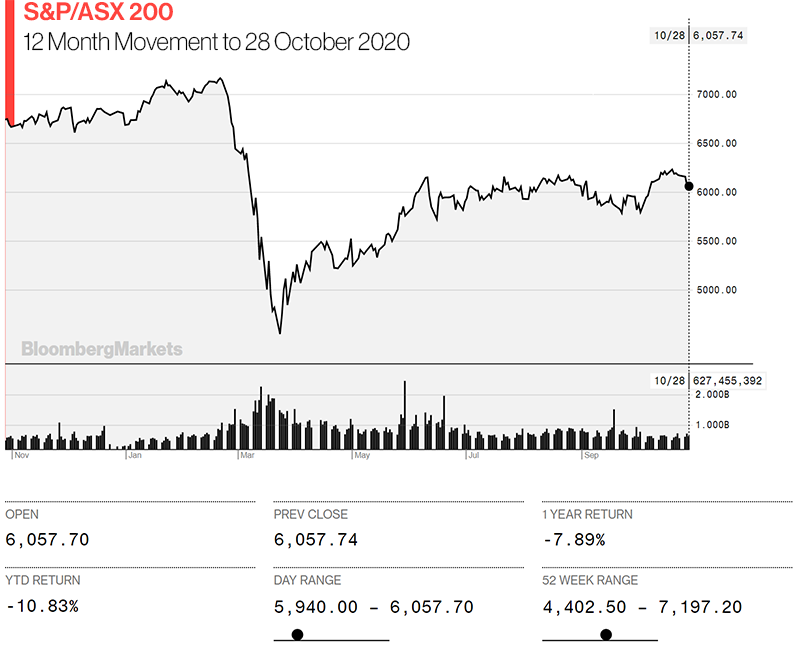

However, the first weeks of October saw strong rises in markets as demonstrated by the ASX200 closing at 6 month record highs at the time of writing (see chart below). Given that the above issues haven’t gone away, the most likely driver of this rally is the Reserve Bank flagging that it is going to cut the Cash Rate to 0.1% in its meeting on the first Tuesday in November. This is in line with our thesis that the low interest rate environment is supportive of strong asset prices.

The most likely influencer of markets is the US election on November 3rd. There are three likely outcomes each with slightly differing impacts on markets in the short-term.

The first scenario is a continuation of the status quo. In such a partisanly divided government (Democrats controlling Congress and Republicans controlling the Senate), most action would necessarily take the form of executive orders, appointments, and repealing regulations (ie tasks that the President can undertake without reference to either Congress or the Senate). Additional fiscal stimulus would be unlikely, even though Trump’s campaign platform promises to “Cut taxes to boost take-home pay and keep jobs in America.” Deregulation would focus on further easing of financial, energy and other regulations, while foreign policy would continue to emphasize unilateralism, and feature intensified strains with China. The reaction from investors to this outcome would likely be positive, pushing risk assets and the U.S. dollar higher, as markets unwind the fear of rising taxes and increased regulations, as the Biden campaign has pledged.

The second scenario involves a Biden win, but with the Senate remaining in Republican control. A split federal government means domestic gridlock, featuring less legislation and more executive orders. Fiscal policy would be similar to the status quo, although the regulatory outcome would be more like the Democratic sweep scenario (focused on energy, the environment and finance). Foreign policy would be more predictable, and less unilateral. Overall, this outcome would likely prove moderately positive for equities.

The third scenario is a Democratic sweep, meaning that the Democrats win the Presidency and the Senate, whilst retaining control of congress. This outcome would feature a progressive agenda, with more spending, more taxes, and more regulation. The tax hikes would focus on corporations and high-income individuals but would likely be smaller and later than the campaign’s proposal, due to the swoosh-shaped recovery and the weak economy. One concern with increasing deficits is that 10 year bond yields could be driven higher, which in turn undermines equity markets (especially long-duration stocks) and housing prices. Other top priorities would include healthcare and pharmaceutical reforms, as well as energy and the environment. Foreign policy would remain tough against China, especially on trade, but would be considerably more multilateral. Finally, equities would likely fall moderately, in the short term, on concerns about higher taxes and increased regulation.

Whilst each scenario may have differing impacts on short term market volatility, history does tell us one thing. Markets always perform strongly in the year after a Presidential election. So our message remains, stick with your longer term investment strategy and look through any volatility immediately surrounding the election.

Important Update regarding Non-Concessional (ie personal) Contributions to Super

Legislation has now been passed that allows people aged 65 or 66 to make personal contributions to super without having passed the “work test”. If you feel you might benefit from this change please contact your Harvest adviser.