At Harvest Financial Group, we’re continuing to monitor the evolving situation of Coronavirus ‘s impact on financial markets and people.

In order to contain the spread of the very contagious Coronavirus (aka COVID-19), governments around the world are taking extraordinary measures to limit person-to-person contact within their populations, which in turn is taking a great toll on economic activity. Working from home is all the rage at the moment.

As a result, share markets around the world and Australia have fallen sharply in recent weeks. Market volatility, or the ups and downs each day in share prices have surged and many investors are fearing the worst. Some are panicking by switching their investments from shares and property to cash. This panic is also manifested in the panic buying of groceries and other supplies. In Australia we have seen panic buying of toilet paper, in the USA it’s bullets and in Ireland it’s Guinness!

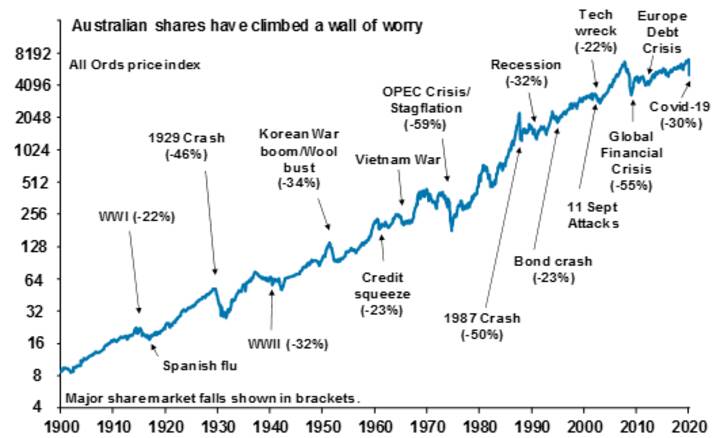

This is not the time to do this. Emotion should not drive investment decisions or your long-term investment strategy. Switching to cash locks in your losses and stops you from regaining future growth when the market rebounds.Yes, it’s a troubling period, but we wanted to reassure you that market falls are inevitably followed by rises.

See the chart below showing this. All the other historical events that have occurred at that time forcing markets to fall, are followed thereafter by rises which keep the market’s long-term growth on track.

While the near-term economic situation seems bleak due to the lockdowns, we believe there are still positive signs to anticipate a degree of stabilisation and recovery in the coming weeks or months – if and when current tough containment measures succeed in limiting the spread of the virus to manageable levels.

We already have seen some evidence of success in this regard in countries such as China, South Korea and Singapore. While that may not prevent further market declines in the short-term, a lot of bad news is now priced into global share markets, and less so the prospect of an eventual economic recovery.

Governments around the world are also reacting in a financial sense by cutting interest rates and providing money to people and business in order to stimulate their economies. We know that everyone is impacted by coronavirus in different ways, and we want to let you know we’re here to support you during this difficult time. We at Harvest are committed to helping meet your financial needs and achieve your financial goals now and into the future. Our staff have been working tirelessly to assist our many clients deal with these matters.

We also wanted to give you the confidence that at Harvest, we’re set up to continue our operations and to support you during this time. You’ll also be able to continue to access Harvest staff for assistance, noting that some of our team are now working from home as a preventative measure and in accordance with Government advice.

If you have an upcoming meeting with a Harvest adviser, we may reach out and ask if you have returned from overseas in the past two weeks, and if so to ask that we hold the meeting via phone or our 3CX video conference facilities. This is part of our commitment to helping both you and our team prioritise their health, and the health of others.

Finally, if you have any specific questions, or you are feeling anxious about your investments, please get in touch with Harvest so we can discuss.

On a personal note we wanted to thank all our staff and clients for their utmost dedication and professionalism in working together during these nervous times.

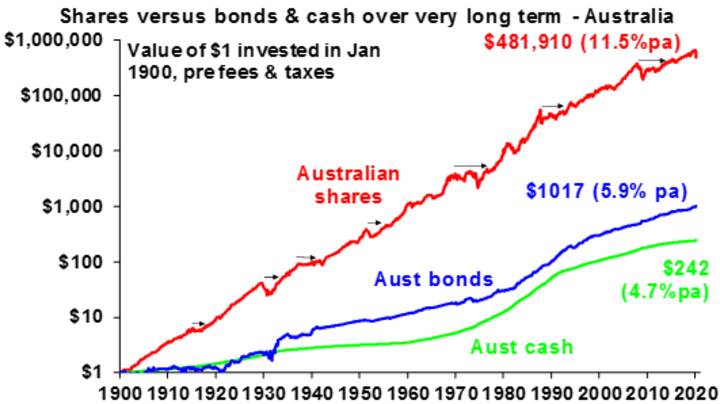

o finish of this communication, below we have the long-term growth of the Australian share market showing $1 invested in 1900 grew to $481,910 by January 2020 with an average return each year of +11.5% pa, far greater than cash at 4.7% pa and bonds at 5.9% pa. Thanks to the power of compound interest and sticking to your investments in the longer term, the outcome at the end of the day is greatest in shares.