Interest rate announcement – June 2017

Today the Reserve Bank of Australia met to review the official cash rate. After last cutting rates in August 2016, the RBA have again decided to leave rates on hold at 1.50% this month. Nonetheless, we have seen some lenders starting to increase their variable and fixed interest rates and we expect others to follow suit.

What is mortgage stress?

Broadly, mortgage stress refers to a situation in which a home owner is paying more than 30% of their income towards repayments on their home loan.

In this article, we look at the recent sharp increase in the number of households experiencing mortgage stress and some tips to help you avoid mortgage stress.

Mortgage stress is on the rise

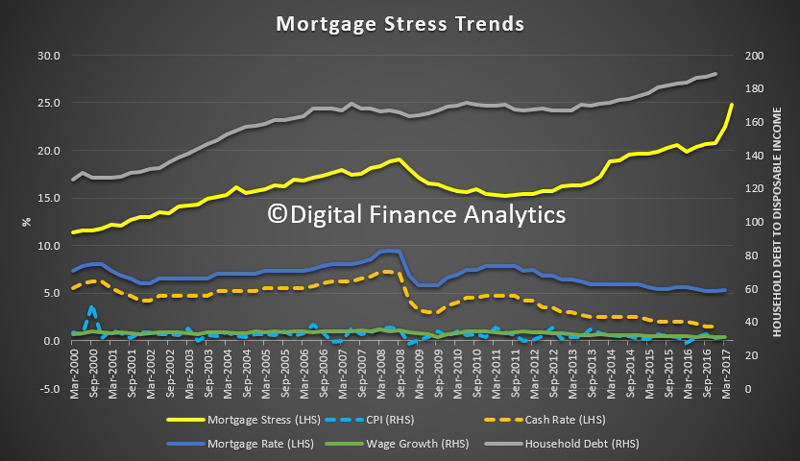

Recent research from Digital Finance Analytics has uncovered that the number of households experiencing mortgage stress has begun to accelerate rapidly over the last 12 months.

As at March 2016, approximately 20% of households were in mortgage stress. This figure has now risen to 25% as at March 2017, and is expected to continue to increase over the next few years.

Source: Digital Financial Analytics

Rising interest rates and living costs, low and in some cases, negative growth in real incomes as well as increasing underemployment (a measure of the number of people who are employed but working less than their desired number of hours) are the main drivers of increasing mortgage stress.

Tips to avoid mortgage stress

Below are a couple of basic tips to help you avoid mortgage stress:

- Start and emergency fund – You never know what might happen into the future, so its important to be prepared. One way to help with this is to build an emergency fund. Ideally, this should cover at least 6 months worth of expenses including mortgage repayments.

- Buy a house you can afford – A substantial number of those experiencing mortgage stress could have potentially avoided it if they had purchased a house that they were able to comfortably pay off, even at a much higher interest rate. It is therefore important that you choose a property well within your affordability range. Generally, this means that you would be able to afford repayments on the associated loan at an interest rate at lease double your current rate.

- Pay more than the minimum repayment – Getting into this habit early will help you to pay off you loan much faster and may help give you more flexibility should you experience some unforeseen circumstances at some stage into the future.

As always, the home loan experts at Harvest are available to offer you advice and assistance with your loan. If you would like help with any of the issues or strategies discussed in this newsletter, please don’t hesitate to contact us.

Our Current Best Interest Rates

The best home loan rates we currently have available:

- Variable rate of 3.74% pa

- 1 year fixed rate of 3.69% pa

- 2 year fixed rate of 3.69% pa

- 3 year fixed rate of 3.88% pa