Investment Newsletter – January 2014

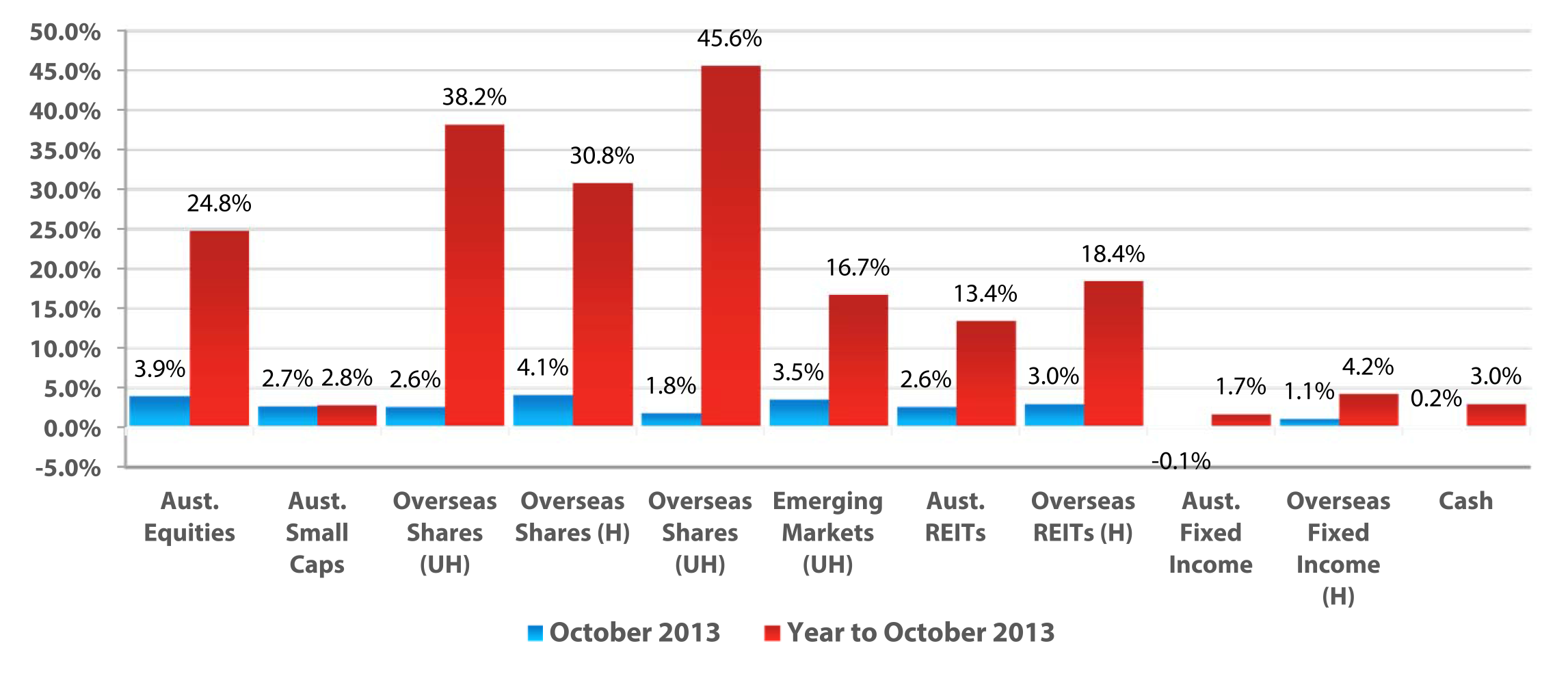

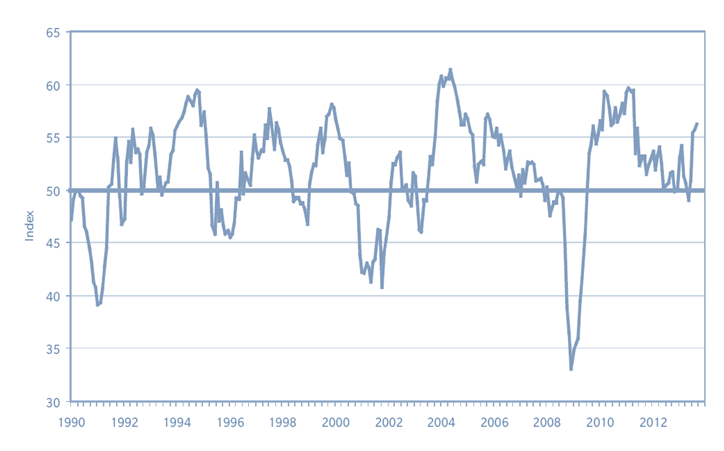

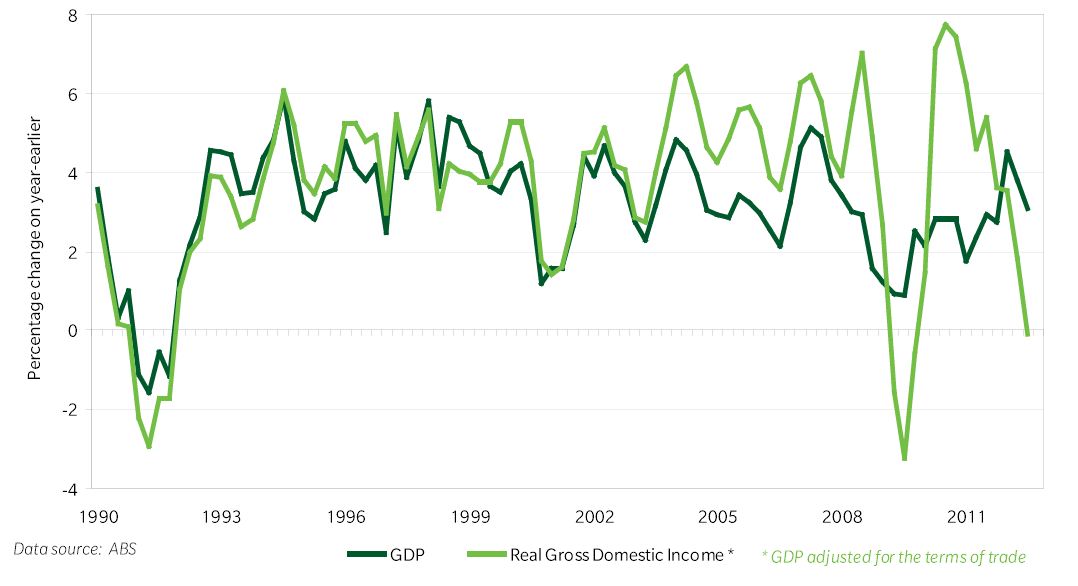

Director's Perspective By Mario Isaias Welcome to the New Year and I trust you had a wonderful festive season with family and friends. The previous calendar year will be remembered as one of the better investment years. With low interest rates and central bank support, most markets performed very well, led by the U.S. -