Investment Newsletter – December 2014

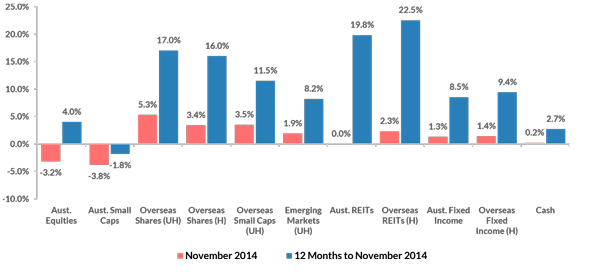

Director's Perspective By Mario Isaias Welcome to our last edition in 2014 of our Investment Newsletter. We are excited to announce that in 2015 we will be revamping this newsletter to enhance the content and timing. We know you will enjoy this fresh approach. November in Australia was generally a “minus 3% month”. Both the