Investing for income in retirement

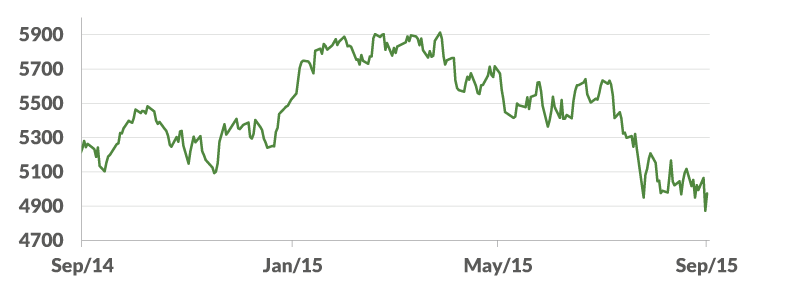

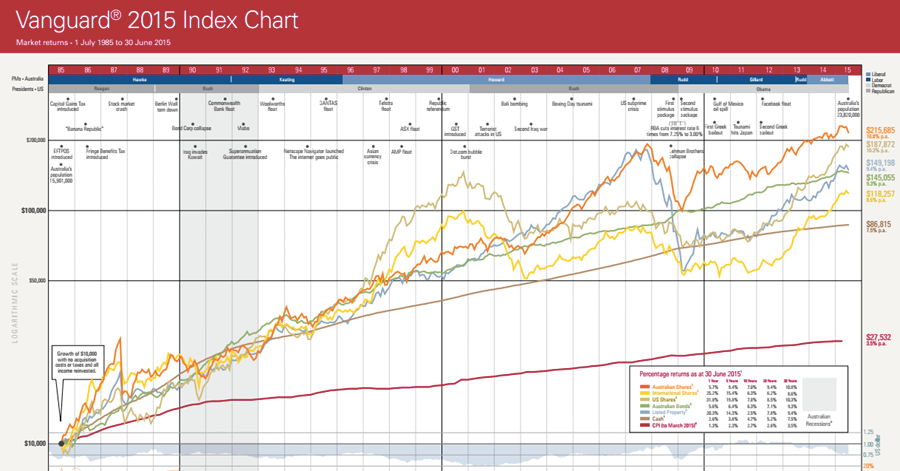

A large number of Australia’s population are approaching retirement age and looking for an income stream to fund their retirement. By law retirees aged between 65 and 74 need to drawdown a minimum of 5% of the value of their pension investments each year. Unfortunately, a conservative investment portfolio will generally provide a return below