Reserve Bank interest rate announcement – October 2014

Today the Reserve Bank of Australia met to review the official cash rate. They have decided to leave this rate steady at 2.50% pa. The official rate has remained unchanged for 13 months now. We expect that most lenders will leave their rates unchanged, in line with the Reserve Bank’s decision.

Getting the most from your home loan

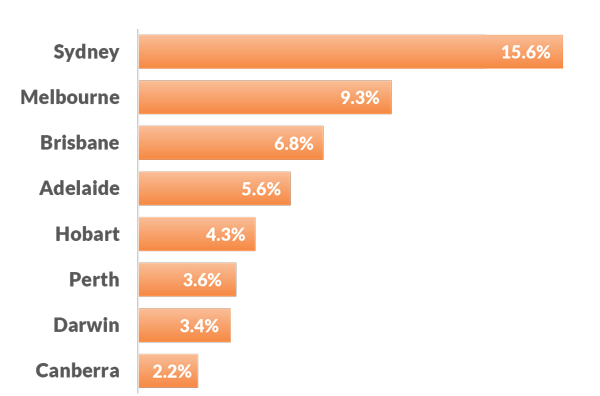

Consistently low interest rates and a growing population have driven up prices for property, particularly in Sydney (+15.6%) and Melbourne (+9.3%), as home buyers and investors look to capitalise on market trends. Due to this, mortgage providers are offering incentives for you to make the switch.

The most important part of a good value home loan deal is the interest rate on repayments. Something to consider is whether you want a fixed interest or a variable interest loan, or a combination of both. Choosing between these often comes down to your personal financial situation and your expectation of future interest rates, and should be considered carefully.

In the current market, if your home loan rate is higher than 5% it would be worthwhile to look at all the available options. Harvest can assist you here. All you need is a copy of your most recent home loan statement and we do the rest . It’s that easy.

At Harvest we provide independent advice about home loans based on your personal financial situation. We do not provide the loans and we have access to 30 loan providers to make sure you get the best value home loan. As we only give advice, we don’t favour any particular lender, so we can tailor a package for you that meets all your needs.

Australia’s property market not in a bubble

Some international commentary over the last few months have categorised Australia’s growth in the housing market as a ‘housing bubble’.

A housing bubble occurs when the property market experiences a period of high growth, where growth is not linked to fundamental factors that drive demand. Eventually, demand drops, until the supply is much greater than demand, making property much less valuable. Effectively ‘popping’ the housing bubble.

The reason we believe Australia’s property market is not a housing bubble is that rising house-prices are linked to fundamental growth factors. These include increasing levels of foreign investment, growing population, relatively low stock levels and sustained low interest rates. Supply, especially in Sydney and Melbourne, is not meeting current demand.

12 month price increases to June 2014

Price increases in Australia’s property market have been strong between June 2013 and June 2014, with a national average increase of 10.1% (weighted) compared with an inflation rate of 3%. But most of this price increase has been concentrated in Sydney (15.6%) and Melbourne (9.3%).

Click Here to download a PDF of this newsletter

Leave A Comment

You must be logged in to post a comment.