Global share markets have performed strongly for the quarter ending 30 September 2012. Some key developments influencing markets at the moment include:

Australian Cash Rate

The Reserve Bank of Australia (RBA) has dropped the official cash rate to 3.25% pa mainly due to a softening global economic outlook, slowing growth in China (and the developing world), and the need to stimulate the non-mining sectors of the Australian economy. A further cut before December is also possible depending on these factors and subject to inflation remaining within the RBA’s target range of +2% to +3% pa.

Chinese Growth Slowing

Economic growth in China is slowing as reflected by a fall in the manufacturing and non-manufacturing PMI indexes. However the non-manufacturing index remains relatively high. Overall annual GDP growth is still forecast to be just above +7.0% pa.

Positive US Economic Data

The Institute for Supply Management (ISM) business conditions index rose, unemployment rate dropped to +7.8% (below +8.0% for the first time since the Global Financial Crisis), consumer credit rose and the central bank announced a third round of quantitative easing (i.e. QE 3). This is expected to result in continued rising investor confidence in the US. All eyes now on the Presidential election in November.

Spain’s Sovereign Debt

Spanish short term Government bond yields have come down significantly since the European Central Bank commenced purchasing these bonds in the open market. However, it is expected that Spain will eventually need to apply for assistance from the EU (European Union).

10 Year Spanish and Italian Government Bonds

Source: JP Morgan

Australian Economic Data Generally Soft

House prices have fallen over the last year, however rose in September 2012. Retail sales were up slightly in September but below long term average levels. Business conditions for manufacturing, services and construction have weakened and inflation in September rose slightly.

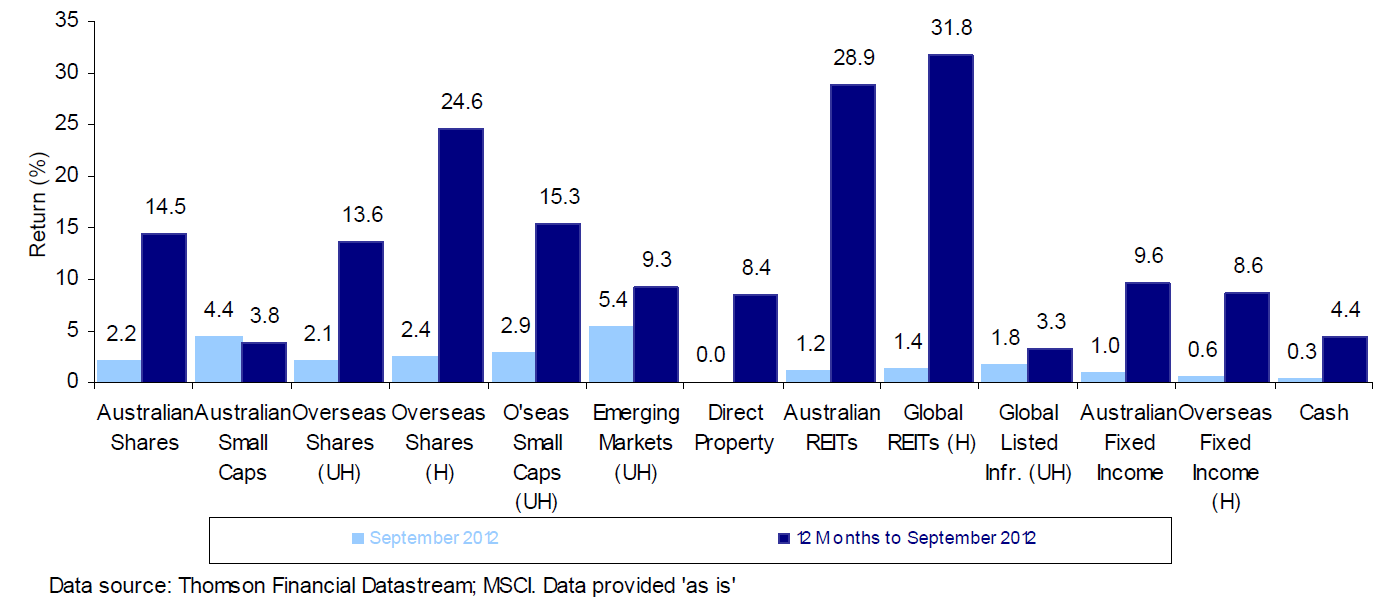

Selected Market Indicators Commentary for the Month Ending 30 Sept 2012

by Asset Class

Source: Thomson Financial Datastream; MSCI data provided ‘as is’

Australian Shares

The Australian Share market rallied in the September 2012 month, with the ASX S&P 200 up +2.2%. The impetus for the rise largely reflects improvements in the Price Earnings ratio for many companies (globally there is rising confidence that the developed world can manage sovereign debt issues, however global economic growth is slowing to around +3.0% pa). We expect the Australian Equity market as measured by the ASX 200 index, to now trade in the range of 4,300 to 4,800 for the rest of the 2012 calendar year.

Overseas Shares

Most global equity markets posted strong gains in September, as investors began to feel that the sovereign debt issues can be managed through central banks buying bonds to keep interest rates at manageable levels.

The MSCI World Index returned +2.8% in US dollar terms and +2.1% in $A terms (as the $A dropped over the month). The S&P 500 index returned +2.6%, while the NASDAQ returned +1.6% local currency terms.

European markets were generally also up – the German DAX 30 (+3.5%) and the UK FTSE 100 (+0.7%). However, the French CAC 40 was down (-1.2%).

Asian markets were also strong with Japan up (TOPIX +1.8%), China up (Shanghai Composite +1.9%) and Hong Kong was also up (Hang Seng +7.5%).

Property

Domestic Real Estate Investment Trusts (REITs) as measured by the benchmark S&P/ASX 300 A-REIT Index finished the September month up +1.2%. Global REITs appreciated +1.4% (as measured by the FTSE EPRA/NAREIT Developed Index) on a fully hedged basis.

Fixed Interest

In Australia, Commonwealth bond yields increased slightly resulting in a +0.6% return for the month of September (as measured by the UBS Treasury Bond Index). Global bond returns were +0.6% as measured by the Citigroup World Government Bond (ex-Australia) Index.

Australian Dollar

In general, the Australian dollar weakened during the September month against other major currencies (with the exception of the $US where the $A was up +0.6%) due to concerns about Chinese and World economic growth slowing, resulting in lower commodity prices.

©2012 Harvest Employee Benefits. This Newsletter has been prepared for Harvest’s clients. The information contained herein is current and up to date at the time it was prepared. Harvest Employee Benefits Pty Ltd, ABN 74 107 226 693 is a Corporate Authorised Representative and Mario Isaias, Noel Hucker and Inbam Devadason are Authorised Representatives of Harvest Financial Group Pty Ltd, ABN 80 111 998 068 AFS Licence No 284909. Harvest reserves the right to correct any errors or omissions. Any advice contained herein has been prepared without taking into account any individual persons objectives, financial situation or needs. As such, before acting on any information contained herein, a person should consider whether the information is appropriate for that person, having regard to their objectives, financial situation and needs. The relevant Product Disclosure Statement should be obtained and read before making any decision regarding information contained in this Newsletter.[/box]

Leave A Comment

You must be logged in to post a comment.