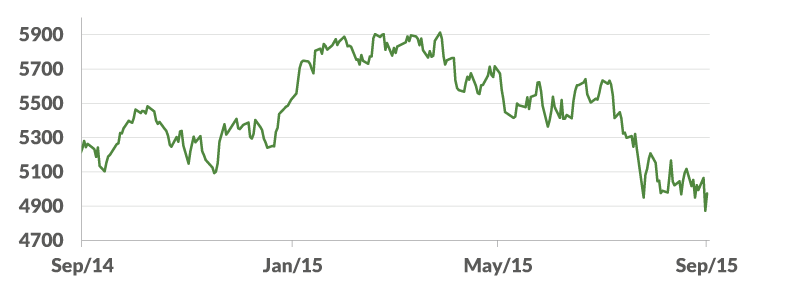

US Federal Reserve increases interest rates

In what has been perhaps the most discussed and debated interest rate decision of all time, the US Federal Reserve (Fed) increased their Federal Funds target interest rate range by 0.25% to 0.25-0.5% at their December meeting. This is the first rate move since the Fed reduced its target rate range to a historic low