With the turmoil in the markets since the beginning of the year, it can be quite unsettling for investors and those relying on their super for their income. Additionally, given the nerve-wracking uncertainty of a possible trade war and its threat of recession, prospects may seem dire for the world economy as a whole. Nonetheless, this is the risk we all face when investing in equities and bonds in world markets, for which we expect to be rewarded!

Now is a good time to remind ourselves of the two principles that drive higher-expected long-term returns:

- The trade-off between reward and risk.

- Markets always reward long-term investors.

Reward and risk

We expect to be compensated for taking a risk. The risk I am talking about here is market or systematic risk as opposed to unsystematic risk (such as when you try to pick a group of shares that you think will beat the market). Systematic risk is also called compensated risk, which means that, as long as you stay invested over the long-term, you can expect to achieve higher returns than cash or other fixed interest investments. If there were no risk – and by risk, we mean the volatility of share prices – then there is no expected reward.

A sure thing that has no risk will almost certainly not deliver higher returns. Those touting otherwise should be avoided.

Markets always reward long term investors

Staying invested in the markets is primarily achieved through broad diversification. This is achieved through ensuring that you do not have too much concentration in one industry, one country, or one asset class. As John Bogle famously states, “if you want to make sure you always find the golden needle, just buy the haystack”.

It is also important to remind ourselves that, although there is risk and downturns – and even crises – they have never been long-lived, and (most importantly), the sharpest rises in value have occurred just following a crisis. All the more reason to stay invested, and not to react to any turbulence.

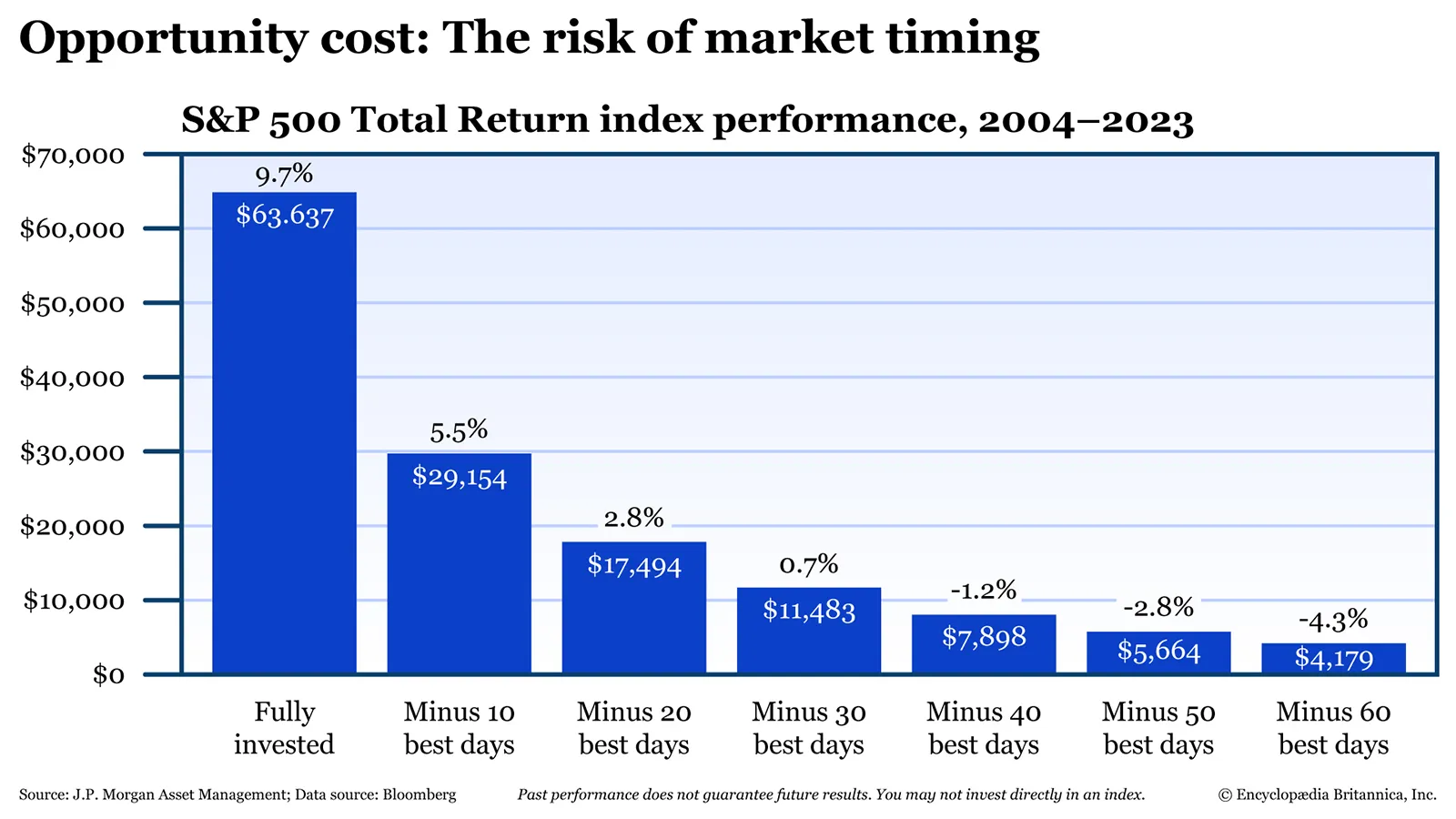

Reacting to the market – for example, by selling down into cash until it is safe to get back in – will mean you could risk missing out on some of the best days of a growth rally. The effects of this can be catastrophic on your returns:

It is also reassuring to note that in every decade, markets tend to produce six strong years and four weaker ones, with the line in value always trending upwards.

So, the secret to successful investing is to hang in there!