As we write, stockmarkets around the world seem to have finally taken notice of the Coronavirus outbreak. We are seeing headlines like “market tumbles” and “$50 billion wiped off market”. In spite of the virus being regarded as having serious economic consequences for some weeks now, the sell off seems to have been triggered by the recent spread of the virus into South Korea, Italy and Iran. The reality is that the potential economic consequences were serious enough when it was mainly confined to China.

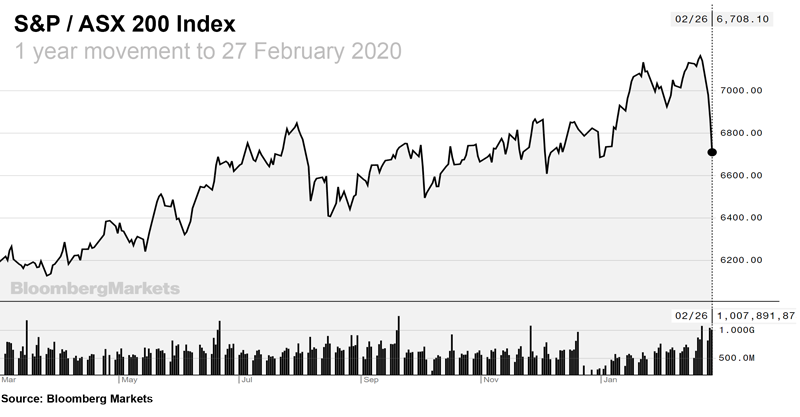

Firstly, lets put the scary headlines into perspective. The chart at the top of this article shows the ASX 200 index for the past 12 months, up to and including the falls on Wednesday the 26th of February. It should be readily apparent that the falls are a slight dent in a steadily upward trend. If you look closely, you can see that the falls in August last year, which were driven by commentary on the US-China Trade War, were just as great. Yet, as always, the market recovers from this short-term noise.

So our message remains to not panic when others are. History has shown that staying invested through short term volatility results in the best long-term outcome. Apart from avoiding the risks associated with market timing (firstly when to get out of the market and then, when to get back in), you also continue to receive the distribution income from your investments. Distribution returns are largely independent of market volatility. A message that we are constantly reinforcing with those of our clients whose super is in pension mode.

This is not to mean that we should be complacent. There are material downside risks here. The TV news showing empty streets in Wuhan and even Beijing points to lower consumer demand because people cannot go out to buy anything more than the basic necessities. it points to factories being closed because workers can’t get to work, it points to disrupted supply chains because goods cannot be moved. So if the virus cannot be contained quickly there could be a material impact on the Chinese economy, which will necessarily flow on to the Australian economy.

Anecdotally, we hear that retailers are struggling to source Chinese produced stock. Think clothing, electronics and televisions for starters. And of course Chinese tourists and students, who aren’t able to travel, aren’t spending their money here either.

This potential risk to our economy will be front of mind when the RBA board sits next Tuesday. A rate cut from 0.75% to 0.50% is now almost a certainty for the March or April meeting, with further cuts likely later in the year.

However, monetary policy can only go so far and is starting to lose its full impact, which means that fiscal policy becomes the main lever to prop up the economy. In short, the Federal Government will need to start spending more. At the recent G20 meeting, both France and Italy indicated that fiscal policy would now be used in their countries to provide the required economic boost. The combination of the bushfires and the virus provides the government with the political “get-out-of-jail card” it needs to do the same.