Superannuation investment options

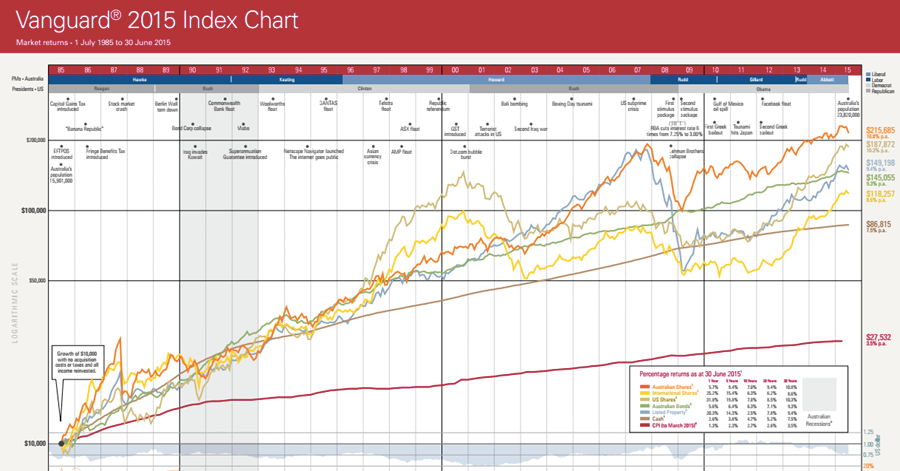

Choosing your investment options within superannuation How you manage your money within superannuation over the long term can make a big difference to your final balance. For some people, superannuation will be their largest pool of wealth so the decisions you make today should not be taken lightly. Most super funds have a number of