As we write the Australian Stock Market (as measured by the ASX200) is down 22% from its high point back on the 21st of February whilst the NZ 50 is down 12%. On the 23rd of March, the Australian market was down over 36%, while NZ was down 30% – an extraordinary fall in just one month. The recovery hasn’t been quite as spectacular so far but has been sustained as shown in the chart.

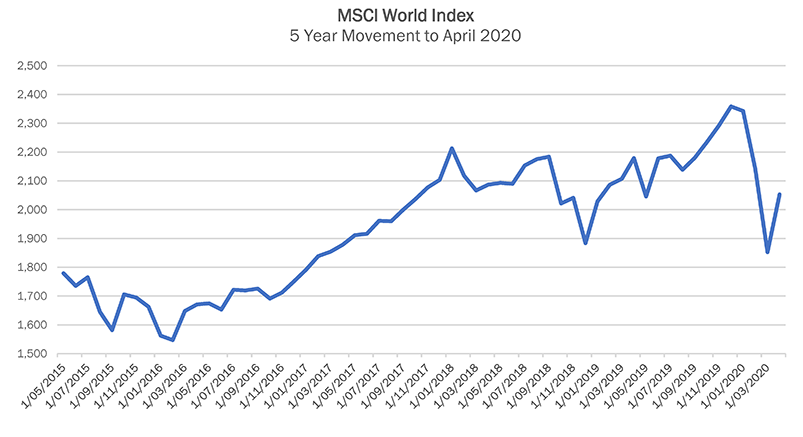

By contrast stockmarkets in the developed world (as measured by the MSCI World Index) fell 32% from its February highs but is now only 14% down. This relative out performance over the Australian market is almost entirely due to the US tech giants (Facebook, Amazon, Apple, Alphabet (which owns Google), Netflix and Google – otherwise known as the “FAANG” stock) all of which have performed strongly during the crisis.

There are two key takeouts from the above. Firstly, it’s always wise to stay invested when others are panicking and sell out. To have cashed out in mid-March would have crystallised some significant capital losses and meant missing out on the recovery. Our consistent message is that you can’t consistently time the market with any degree of success. Market timing only works in hindsight.

The second point is that diversification is important. Evidence shows that DIY investors are largely invested in Cash and Australian Equities with next to no exposure to International Equities. So this type of portfolio would still be down 22% whereas holding International Equities would have lessened the blow due to their speedier recovery.

As we cautiously come out of lockdown we can look towards identifying events that might provide further impetus to the recovery in the value of your investments. The most likely kicker will be an effective treatment for those who have the disease thereby providing confidence to governments to open society up more as the downside risks of the disease can be managed.

In the three months since Covid 19 emerged, over 1,100 clinical studies have been registered globally, focusing on three main drugs: hydroxychloroquine (study currently suspended by the WHO), an anti-malarial drug that is also used to treat auto-immune illnesses such as lupus and rheumatoid arthritis; lopinavir/ritonavir and remdesevir (which was effective against SARs, another type of coronavirus).

The second point is that diversification is important. Evidence shows that DIY investors are largely invested in Cash and Australian Equities with next to no exposure to International Equities. So this type of portfolio would still be down 22% whereas holding International Equities would have lessened the blow due to their speedier recovery.

Further impetus will come from the development of a vaccine that can be scaled to treat billions. There is no guarantee that a vaccine will be found and even if it can be done the best case scenario seems to be that one won’t be available for 12-18 months, if at all.

Finally a quick point on house prices. Some of the more shrill news outlets have jumped on predictions by some of the more bearish forecasters that house prices will fall by 30%. This is simply not being borne out by the evidence. There has been a small percentage drop in the median house price in Melbourne whereas in Sydney it has remained steady for the past couple of months. Meanwhile, in NZ, the Auckland median house price was down 2.1% in April according to REINZ. We’ll keep an eye on the data but at this stage we seen no cause for concern.

General Advice Warning

This newsletter has been prepared for Harvest’s clients and the information contained herein is correct and up to date at the time it was prepared. Harvest Employee Benefits Pty Ltd (ABN 74 107 226 693) is a Corporate Authorised Representative of Harvest Financial Group Pty Ltd (ABN 80 111 998 068, AFSL No. 284909). No information in this newsletter should in any way be construed as an investment recommendation of any kind. Harvest reserves the right to correct any errors or omissions. Any views expressed herein are the views of the author/s and could involve assumptions which may or may not prove valid. These are subject to change without notice. This newsletter has been prepared without taking into account any individual person’s objectives, financial situation and needs. A person should carefully consider their personal objectives, situation and needs before taking any action based on the information contained in this newsletter. © Copyright 2020. Prepared by Harvest Financial Group. Data is the latest available.